Loading

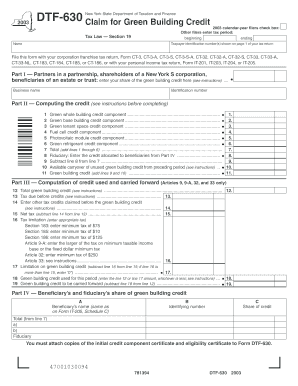

Get Dtf-630 Claim For Green Building Credit Tax Law -- Section 19 Name New York State Department Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DTF-630 Claim for Green Building Credit Tax Law -- Section 19 Name New York State Department Of online

This guide provides a clear and comprehensive overview of how to fill out the DTF-630 Claim for Green Building Credit Tax Law -- Section 19. Whether you are a business entity or an individual taxpayer, these instructions will help simplify the process of completing this important form online.

Follow the steps to accurately complete your DTF-630 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by checking the appropriate box for 2003 calendar-year filers, or entering the tax period if you are filing for another year.

- Enter your name as the taxpayer and ensure the taxpayer identification number(s) matches those shown on page 1 of your tax return.

- File this form in conjunction with your corporation franchise tax return or personal income tax return indicated in the instructions.

- In Part I, report your share of the green building credit in the designated field. Provide the business name and identification number.

- Proceed to Part II to compute the credit. Complete each line corresponding to the various green building credit components, ensuring that all calculations are accurately documented.

- In Part III, calculate the total green building credit and your tax due before credits, then determine your net tax and any other applicable tax credits.

- In Part IV, list the beneficiary's name, identifying number, and their share of the credit. Total this amount as required.

- Attach copies of the initial credit component certificate and eligibility certificate to Form DTF-630 before submission.

- Once all sections are filled out and verified for accuracy, save your changes, download, print, or share the completed form as necessary.

Start your filing process for the DTF-630 online today to ensure you maximize your green building credit.

You are eligible for this nonrefundable credit you were a full-year or part-year New York City resident, and cannot be claimed as a dependent on another person's federal tax return. Individuals who are filing as Single and have a federal adjusted gross income of $12,500 or less may receive up to $15 for this credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.