Loading

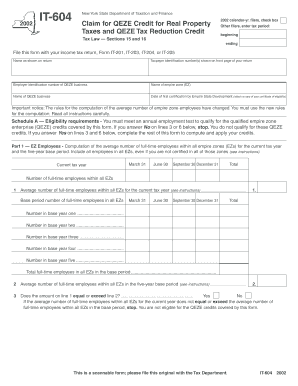

Get It-604 New York State Department Of Taxation And Finance Claim For Qeze Credit For Real Property

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-604 New York State Department of Taxation and Finance Claim for QEZE Credit for Real Property online

Filing the IT-604 form allows you to claim the Qualified Empire Zone Enterprise (QEZE) credit for real property taxes. This guide provides a clear step-by-step process for completing the form online, ensuring that users can navigate through each section effectively.

Follow the steps to complete the IT-604 form online.

- Click ‘Get Form’ button to obtain the IT-604 form and open it in your editor.

- Begin by indicating whether you are a 2002 calendar-year filer by checking the appropriate box. If you are an other filer, enter the tax period including the beginning and ending dates.

- Provide your name as shown on your tax return, along with the taxpayer identification number(s) that are listed on the first page of your return.

- Enter the employer identification number of the QEZE business and name the empire zone (EZ) along with the QEZE business name.

- Indicate the date of first certification by the Empire State Development and attach a copy of your certificate of eligibility.

- Complete Schedule A by computing the average number of full-time employees within all empire zones (EZs) for the current tax year and the five-year base period. Include all employees in applicable EZs.

- Proceed to answer the questions in Schedule A stating whether the number of employees in the current tax year meets the required thresholds.

- Complete Part 2 for the computation of full-time employees working inside New York State and outside all EZs, ensuring that all values are accurately filled according to instructions.

- Fill out Schedule B, which focuses on the average number of full-time employees in the EZs during the current tax year.

- Calculate the employment increase factor in Schedule C based on the values derived from previous schedules.

- Continue to complete Schedule D, noting the zone allocation factors, including the average value of property and wages.

- Proceed with Schedule E to determine the tax factor by inputting values from your relevant tax forms.

- Complete Schedule F, focusing on the computation of QEZE credit for real property taxes and ensuring all figures are captured correctly.

- Finalize with Schedule G, which calculates QEZE tax reduction credit, and cross-reference values required from previous schedules.

- Review all entries for accuracy. You can now save the form, download, print, or share it as necessary.

Complete your IT-604 form online today for a smooth and successful filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.