Loading

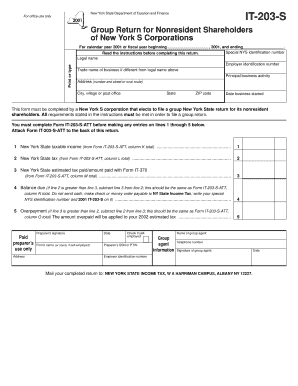

Get For Office Use Only New York State Department Of Taxation And Finance It-203-s , 2001, And Ending

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For Office Use Only New York State Department Of Taxation And Finance IT-203-S, 2001, and Ending online

This guide provides clear, step-by-step instructions on completing the For Office Use Only New York State Department Of Taxation And Finance IT-203-S, 2001, and Ending form online. Whether you are new to tax forms or familiar with tax processes, you will find this information helpful.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the special NYS identification number at the top of the form. This number is crucial for processing your return.

- Next, fill in the legal name of the business. Ensure it is spelled correctly as this will be used for official purposes.

- Enter the employer identification number, if applicable. This can usually be found on previous tax documents.

- If your business has a trade name that differs from the legal name, fill this in the designated space.

- Describe the principal business activity of your corporation succinctly to give context to your return.

- Complete the address section with the street number, street name, city, state, and ZIP code for accurate mail delivery.

- Indicate the date your business started operations, as this information is relevant for tax timelines.

- Proceed to fill out lines 1 through 5 with the appropriate figures from Form IT-203-S-ATT as instructed. Attach this form at the back once completed.

- Finally, review your entire form for accuracy, then save your changes, and download or print the form for submission.

Complete your New York State IT-203-S form online today for a seamless filing experience.

Nonresidents who wish to claim a refund on NYS taxes or whose NY adjusted gross income (federal column amount) exceeds $8,000 should file the following forms: IT-203 “Nonresident and Part-year Resident Income Tax Return”

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.