Loading

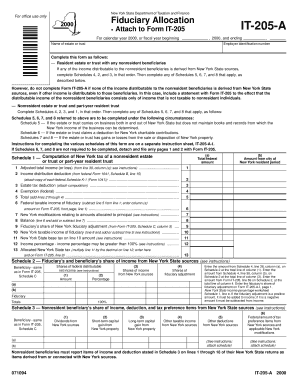

Get For Office Use Only New York State Department Of Taxation And Finance Fiduciary Allocation Attach

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For Office Use Only New York State Department Of Taxation And Finance Fiduciary Allocation Attach online

This guide provides clear instructions on filling out the For Office Use Only New York State Department of Taxation and Finance Fiduciary Allocation Attach form. Whether you are a resident estate or trust, or a nonresident estate, this comprehensive guide will walk you through each step of the process.

Follow the steps to successfully complete the form.

- Use the ‘Get Form’ button to obtain the Fiduciary Allocation Attach form and access it for editing.

- Begin by entering the name of the estate or trust in the designated area. Make sure to provide the employer identification number correctly for easy verification.

- If your estate or trust is a resident entity with nonresident beneficiaries, you will need to complete Schedules 4, 2, and 3 in that order. Ensure that you follow the specific instructions for each schedule.

- If your estate or trust is nonresident or part-year resident, you should complete Schedules 4, 2, 3, and 1, following the same sequence outlined.

- Complete any additional Schedules 5, 6, 7, and 8 that apply to your situation, based on the income sources and deductions available.

- Make sure to review detailed instructions on completing each of the schedules. They can typically be found on a separate instruction sheet referenced as IT-205-A-I.

- In cases where Schedules 6, 7, and 8 are not needed, you can detach and file only pages 1 and 2 with your Form IT-205.

- Finally, review all entries for accuracy, and once satisfied, you can save the changes, download a copy, print the form, or share it as necessary.

Complete your Fiduciary Allocation Attach form online today for timely processing.

You can deduct part of your maintenance costs such as heating, home insurance, electricity and cleaning materials. You can also deduct part of your property taxes, mortgage interest and capital cost allowance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.