Loading

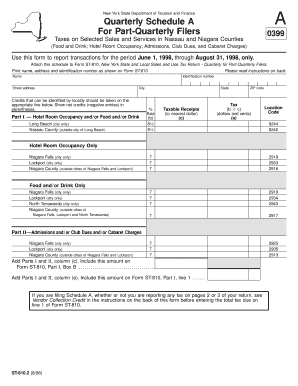

Get New York State Department Of Taxation And Finance Quarterly Schedule A For Part-quarterly Filers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance Quarterly Schedule A For Part-Quarterly Filers online

Filling out the New York State Department Of Taxation And Finance Quarterly Schedule A for Part-Quarterly Filers is an essential task for vendors operating in Nassau and Niagara Counties. This guide provides a clear and detailed approach to ensure accuracy and compliance while filing the form online.

Follow the steps to successfully complete your Quarterly Schedule A online.

- Click ‘Get Form’ button to access the form and open it for completion.

- Begin by entering your name, identification number, street address, city, and ZIP code as shown on Form ST-810.

- Complete Part I for hotel room occupancy and/or food and/or drink sales. Report taxable receipts to the nearest dollar on the specified lines based on your location in either Nassau or Niagara Counties.

- In Part II, enter receipts for admissions, club dues, or cabaret charges, ensuring they are distinctly reported based on the city's tax regulations.

- Add the total amounts from Parts I and II in column (c) and (e), respectively, and include these totals in the corresponding boxes on Form ST-810.

- Review the instructions regarding vendor collection credits and complete any necessary calculations to determine your net tax due.

- Ensure all entries are correct before saving any changes. After completing the form, you can download, print, or share it as needed.

Start completing your New York State Department Of Taxation And Finance Quarterly Schedule A online today.

New York sales tax filing due dates Filing FrequencyDue Date Quarterly For quarterly filers, sales tax returns are due on the 20th of the month following the end of the reporting quarter. Yearly For yearly filers, sales tax returns are due on March 20 of the following year.1 more row

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.