Loading

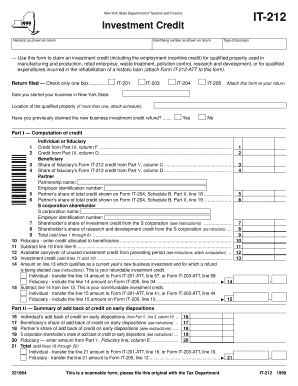

Get New York State Department Of Taxation And Finance Investment Credit Name(s) As Shown On Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance Investment Credit Name(s) As Shown On Return online

This guide provides clear and detailed instructions for filling out the New York State Department of Taxation and Finance Investment Credit Name(s) as shown on Return form. Whether you are a business owner or tax professional, following these steps will ensure an accurate submission of your investment credit claim.

Follow the steps to correctly complete the investment credit form.

- Click the ‘Get Form’ button to obtain the required form and open it in your editor.

- Identify and fill in your name(s) as they appear on the return at the top of the form.

- Provide your identifying number as shown on your tax return, ensuring accuracy to avoid processing delays.

- Indicate the type of business you operate in the designated field.

- Select the appropriate return filed by checking the box corresponding to IT-201, IT-203, IT-204, or IT-205.

- Record the date when you started your business in New York State.

- Specify the location of the qualified property. If applicable, attach a schedule detailing multiple locations.

- Answer the question on whether you have previously claimed the new business investment credit refund by selecting yes or no.

- Move to Part I, and begin the computation of credit by filling out the related fields, ensuring to transfer and calculate credit amounts from columns F and G as indicated.

- Complete Part II regarding the add back of credit on early dispositions, providing necessary details as per the instructions.

- In Part III, detail each investment in qualified property, listing the description, principal use, date acquired, useful life, and credit base in the appropriate columns.

- For any early dispositions, complete Part IV by supplying necessary details of properties and calculations as instructed.

- In Part V, identify the beneficiaries and their respective shares of investment credit and add back of credit amounts.

- After verifying all fields are complete and accurate, save your changes. You may also have the options to download, print, or share the form as needed.

Complete your documents online to ensure accurate and timely submissions.

Eligible technologies include solar thermal process heat, solar thermal electric, solar water heat, solar space heat, fuel cells, geothermal direct use, biomass, wind, geothermal heat pumps, and others.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.