Loading

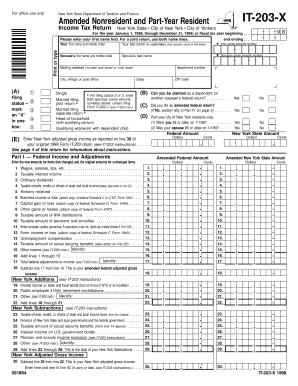

Get For Office Use Only New York State Department Of Taxation And Finance Amended Nonresident And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the For Office Use Only New York State Department Of Taxation And Finance Amended Nonresident And online

Filling out the For Office Use Only New York State Department Of Taxation And Finance Amended Nonresident Form (IT-203-X) can be a straightforward process when guided effectively. This comprehensive guide will help users understand each section of the form, ensuring all necessary details are accurately provided for successful filing.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your first name and middle initial in the designated area. For joint returns, provide both first names.

- Enter your last name and, if applicable, your spouse's name on the line below.

- Input your social security number and your spouse’s social security number if filing jointly.

- Complete your mailing address, including apartment number, city, state, and ZIP code.

- Mark your filing status by placing an ‘X’ in the appropriate box: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Indicate whether you can be claimed as a dependent on another taxpayer’s federal return by selecting yes or no.

- If you filed an amended federal return, specify yes or no and explain if necessary.

- For part-year city of New York residents, indicate whether you or your spouse were 65 or older on the specified date.

- Fill out the New York adjusted gross income as noted on your original Form IT-203 return.

- Continue filling out the sections for income adjustments and any applicable credits or deductions.

- Once completed, ensure all information is accurate, then save your changes, print, or share the final document as needed.

Complete your tax documents online today to ensure efficient processing.

A non-resident alien is a foreigner who does not have a substantial presence in the U.S., such as a seasonal visitor. Non-residents are still required to file taxes if they have income in the U.S. State taxes are complicated for non-residents since many people have homes in several states.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.