Loading

Get Delaware Form 1902b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware Form 1902b online

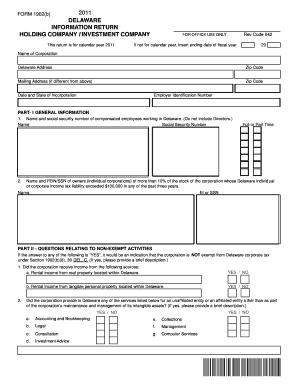

Filling out the Delaware Form 1902b online is essential for corporations claiming exemption from the Delaware corporate income tax. This guide provides a clear, step-by-step approach to ensure accurate completion of the form.

Follow the steps to complete the Delaware Form 1902b online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, General Information. Provide the name of the corporation, its Delaware address, mailing address if different, date and state of incorporation, and the employer identification number.

- In Part I, Line 1, list the name and social security number of compensated employees working in Delaware, excluding directors. Indicate whether they work full or part time.

- For Line 2 in Part I, enter the name and FEIN or SSN of owners with more than 10% of the stock if their tax liability exceeded $100,000 in any of the last three years.

- Proceed to Part II, which contains questions relating to non-exempt activities. Answer each question by checking 'YES' or 'NO' and provide descriptions for any 'YES' responses.

- In Part III, answer questions about exempt activities. Again, indicate 'YES' or 'NO' and provide descriptions for qualifying sources of income over $1 million.

- In Part IV, if applicable, provide additional information about any other sources of income not described in previous parts.

- Finally, sign and date the return by indicating the title of the officer or designee before transmitting the form as required.

- After filling out all sections, save changes, download, or print the form for your records.

Complete your Delaware Form 1902b online today and ensure compliance with state regulations.

For all businesses: Delaware does not have a state or local sales tax. Delaware does, however, have an annual business license requirement, as well as a gross receipts tax that is imposed on the seller of goods or provider of services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.