Loading

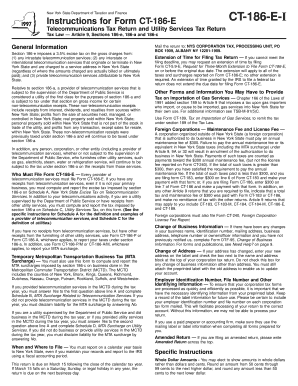

Get New York State Department Of Taxation And Finance Instructions For Form Ct-186-e Telecommunications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance Instructions For Form CT-186-E Telecommunications online

This guide provides straightforward instructions for users to complete the New York State Department of Taxation and Finance Instructions For Form CT-186-E Telecommunications online. Follow these steps to ensure accurate and efficient completion of your tax obligations.

Follow the steps to successfully complete Form CT-186-E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reviewing the general information section which outlines the taxes applicable under sections 186-e and 186-a.

- Identify if you are required to file Form CT-186-E, ensuring you meet the criteria outlined for telecommunication service providers.

- Fill out Schedule A to report the excise tax on telecommunication services, including all required details about gross charges, exclusions, and deductions.

- Complete Schedule B if applicable, which pertains to the MTA surcharge related to telecommunication services provided within the Metropolitan Commuter Transportation District.

- Proceed to Schedule C for reporting the tax on utility services, ensuring all income and deductions are accurately reported.

- Double-check all filled fields for accuracy, ensuring all relevant information from your business operations is included.

- Once all sections are complete, save your changes. You may also download or print the form for your records.

- Submit the completed form along with any required payments to the appropriate mailing address provided.

Stay compliant by completing your tax documents online and ensure all submissions are accurate and timely.

New York State tax warrants expire after 20 years. Importantly, the statute of limitations period starts to run on the first day a tax warrant could have been filed by the Tax Department, not when the warrant was actually filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.