Loading

Get Irs 8911 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8911 online

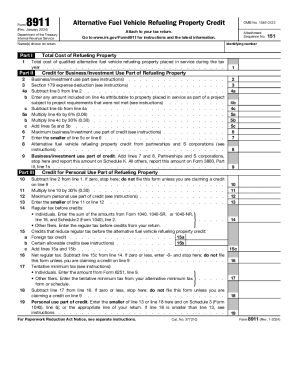

The IRS 8911 form is used to claim a credit for alternative fuel vehicle refueling property. This guide will walk users through the process of filling out this form online, ensuring clarity and ease of understanding for everyone, regardless of their experience level.

Follow the steps to complete the IRS 8911 form online.

- Click ‘Get Form’ button to access the IRS 8911 form and open it in your preferred online editor.

- In Part I, enter the total cost of the refueling property on line 1. This amount should reflect all eligible costs you incurred.

- For line 2, indicate the business or investment use portion of the refueling property, as outlined in the instructions.

- On line 3, report any section 179 expense deductions related to the property.

- Line 4a requires you to subtract line 3 from line 2 to determine the net business/investment use amount. In line 4b, if applicable, enter the amount attributable to property placed in service as part of an incomplete project.

- For line 4c, subtract line 4b from line 4a to find the modified amount.

- On line 5a, multiply the figure on line 4b by 6%. For line 5b, multiply line 4c by 30%.

- Add the results from lines 5a and 5b and enter the total on line 5c.

- In line 6, determine the maximum allowable business/investment use part of the credit as indicated in the instructions.

- On line 7, report the smaller amount between line 5c and line 6.

- If you are a partner or an S corporation, include any alternative fuel vehicle refueling property credit on line 8.

- For line 9, add lines 7 and 8. If you are a partner/S corporation, stop here; otherwise, report on Form 3800.

- In Part II, enter the total cost of qualified refueling property placed in service during the tax year.

- Begin Part III by entering any personal use deductions. If it is zero, do not file unless claiming credit on line 9.

- Calculate the personal use amount on line 11 by multiplying the figure from line 10 by 30%.

- Determine the maximum allowable personal use part of the credit for line 12.

- On line 13, report the smaller of line 11 or line 12.

- Follow through lines 14 to 19 to calculate your net regular tax and total credit applicable to your return.

- Once completed, save your changes, then download, print, or share the form as necessary.

Start filling out your IRS 8911 form online today to claim your credit.

Type in your address or latitude and longitude in the “Search Addresses” bar at the top. This will take you to the tract of your address. If you left click your mouse, the 11-digit census tract GEOID will appear.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.