Loading

Get Or 150-101-064 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 150-101-064 online

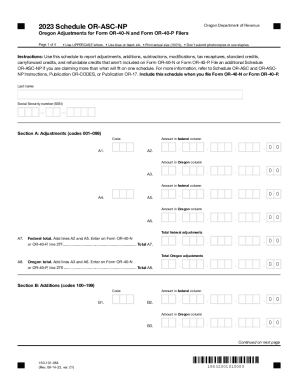

Filling out the OR 150-101-064 form is an essential step for reporting adjustments and credits when filing your Oregon tax return. This guide will provide clear instructions to ensure a seamless online experience.

Follow the steps to complete the OR 150-101-064 form online effectively.

- Press the ‘Get Form’ button to access the form and display it in the online editor.

- Begin filling out the form by entering your last name and social security number (SSN) in the appropriate fields at the top of the form.

- Move to Section A: Adjustments. Here, input your amounts in the federal column next to the corresponding adjustment codes (001–099) and then enter the amounts in the Oregon column.

- Once you have completed the fields in Section A, total your federal adjustments in line A7 and your Oregon adjustments in line A8, entering these totals correctly.

- Proceed to Section B: Additions. Follow the same process as Section A—enter the amounts in both the federal and Oregon columns as indicated and calculate totals for lines B7 and B8.

- Continue to Section C: Subtractions. Input the required amounts in the appropriate columns and calculate your federal and Oregon totals.

- In Section D: Modifications, fill in the necessary details and provide the total modifications in line D7.

- Follow through to Section E: Tax recaptures, entering details and capturing totals as required.

- Complete Section F: Standard credits, carefully tallying and entering your totals for the standard credits.

- Move on to Section G: Carryforward credits and Section H: Refundable credits, ensuring each entry is accurate and all required totals are calculated.

- Once all sections are completed and checked for accuracy, you can save your changes, download, print, or share the form as needed.

Start filling out your OR 150-101-064 form online today to ensure a smooth tax filing process.

Personal computer users may download forms and publications from the IRS Web site at .irs.gov/forms_pubs/index.html. This site also has links to state tax forms and to forms that you can fill in online and then print. Forms and Publications -- How to Order - IRS irs.gov https://.irs.gov › pub › irs-news irs.gov https://.irs.gov › pub › irs-news

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.