Loading

Get O If Amended Return, Mark Circle - Revenue Louisiana

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the O If Amended Return, Mark Circle - Revenue Louisiana online

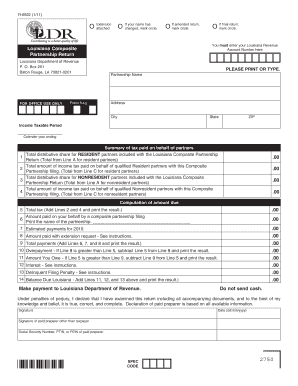

Filling out the O If Amended Return form is an essential part of managing tax obligations for partnerships in Louisiana. This guide provides a step-by-step approach to help users complete the form accurately and efficiently, ensuring compliance with state regulations.

Follow the steps to complete the form online effectively:

- Press the ‘Get Form’ button to access the O If Amended Return, Mark Circle - Revenue Louisiana form in your chosen editor.

- Enter your Louisiana Revenue Account Number at the designated field at the top of the form.

- Indicate if your name has changed by marking the appropriate circle.

- Fill in the partnership name, address, city, state, and ZIP code in the corresponding sections.

- Specify the income tax period by entering the calendar year ending date.

- Complete the summary of tax paid on behalf of partners, including total distributive shares and tax amounts for both resident and nonresident partners.

- Calculate the total tax by adding the respective tax amounts, and record the result in the designated field.

- Enter any estimated payments or amounts paid with an extension request as necessary.

- Sum up total payments from previous lines and enter the result.

- Determine overpayment or amount owed based on the totals calculated in previous steps, marking them appropriately.

- If applicable, fill out the interest and delinquent filing penalty lines according to provided instructions.

- Add any outstanding balances due and write the total in the final field.

- Sign and date the form to certify that the information provided is accurate and complete.

- After you have reviewed the completed form, save your changes, and choose the option to download, print, or share the document as needed.

Complete your documents online today for a smooth filing experience.

Generally, if your return was completed correctly, you can expect electronically filed refunds to take up to 45 days. The LA DOR site says: “The expected refund processing time for returns filed electronically is up to 45 days. For paper returns, taxpayers should expect to wait up to 14 weeks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.