Get This Schedule Is Due With The Monthly Tax Return During Which The Cigarettes Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the This Schedule Is Due With The Monthly Tax Return During Which The Cigarettes Or online

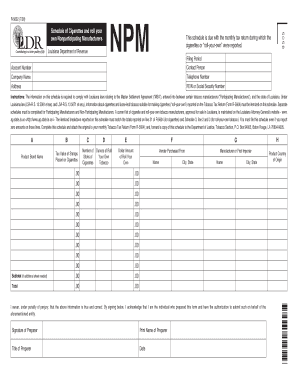

Filling out the Schedule of Cigarettes and Roll Your Own Nonparticipating Manufacturers is a crucial step in complying with Louisiana's tobacco tax regulations. This guide will provide you with clear instructions on how to complete the form accurately and efficiently online.

Follow the steps to accurately complete the schedule online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

- Start by entering your account number in the designated field at the top of the form.

- Fill out the 'Filing Period' field to indicate the relevant month and year for the tax return.

- Provide the contact information, including the contact person's name, company name, telephone number, and address.

- Enter your FEIN or Social Security Number in the specified section.

- Complete the itemized sections by entering the product brand name, tax value of stamps placed on cigarettes, the number of sticks of cigarettes, ounces of roll-your-own tobacco, and the dollar amount of roll your own.

- Record the vendor's name and the manufacturer or first importer details in the appropriate fields.

- Proceed to subtotal the amounts if necessary, completing the 'Subtotal' section if additional sheets are used.

- Calculate the total and fill it out in the 'Total' section.

- Verify the accuracy of the information filled out. Ensure that the reported itemized breakdown matches the totals provided in the related tax return.

- Sign the form at the bottom, entering the preparer's printed name, title, and date.

- Once all fields are complete and verified, save changes to your document. You may then download, print, or share the form as required.

Complete your filing and submit the required documents online today to ensure compliance with Louisiana tax regulations.

Illinois comes in eighth place with an average cigarette price of $8.97 per pack. Vermont ranks ninth with an average cigarette price of $8.82. Finally, Washington is the tenth state with the most expensive cigarettes with a cigarette price of $8.57 per pack. Cigarette Prices By State 2024 - Data Pandas datapandas.org https://.datapandas.org › ranking › cigarette-prices-... datapandas.org https://.datapandas.org › ranking › cigarette-prices-...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.