Loading

Get R-210r (1/08) 2007 Underpayment Of Individual Income Tax Penalty Computation 2007 Taxable Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R-210R (1/08) 2007 Underpayment Of Individual Income Tax Penalty Computation 2007 Taxable Year online

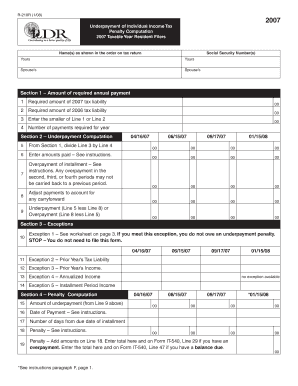

Filling out the R-210R form is essential for accurately reporting any underpayment of individual income tax for the 2007 taxable year. This guide provides clear, step-by-step instructions to assist users in completing this form online, ensuring they understand each component thoroughly.

Follow the steps to complete the form online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your name and Social Security number as they appear on your tax return. If applicable, include your spouse’s details.

- In Section 1, provide the required amount of your 2007 tax liability in Line 1 and your 2006 tax liability in Line 2. Then, enter the smaller amount of Lines 1 or 2 on Line 3.

- Indicate the number of payments required for the year in Line 4.

- In Section 2, divide the amount from Line 3 by the number indicated in Line 4 and enter the result on Line 5.

- Enter the total amounts paid in Line 6, based on the instructions provided.

- Calculate any overpayment of installments and enter the amount on Line 7; note that overpayment from the second, third, or fourth periods cannot be carried back.

- Adjust your payments to account for any carryforward and enter this amount on Line 8.

- Calculate the underpayment or overpayment by subtracting Line 8 from Line 5 and record this on Line 9.

- Proceed to Section 3 and check for exceptions. If you meet Exception 1, you do not need to file this form.

- If applicable, review and check other exceptions such as prior year’s tax liability, income, annualized income, and installment period income. Fill in details as needed.

- In Section 4, list the amount of underpayment from Line 9 on Line 15.

- Provide the date of payment in Line 16 and count the number of days from the due date of the installment, entering it on Line 17.

- Calculate the penalty according to the instructions and enter this on Line 18.

- Add the penalties listed on Line 18 and enter the total on Line 19. Make sure to include this total in the relevant section of Form IT-540 if you have an overpayment or balance due.

- After completing the form, save your changes, and download or print a copy for your records.

Complete your document filings online to ensure accuracy and compliance.

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.