Loading

Get Specific Instructions - Louisiana Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Specific Instructions - Louisiana Department Of Revenue online

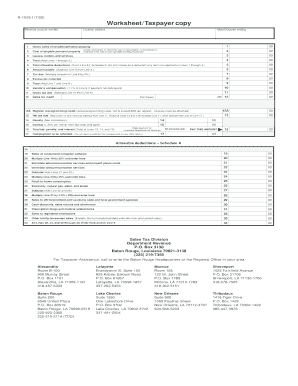

Completing the Specific Instructions for the Louisiana Department of Revenue can streamline your filing process and ensure compliance with state tax regulations. This guide provides you with detailed, step-by-step instructions for successfully filling out the form online.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering your revenue account number and location address in the designated fields. Ensure this information is accurate to avoid processing issues.

- Indicate the month or quarter ending date for which you are filing. This should be placed in the area near the top left corner of the form.

- Proceed to fill in Line 1 with your total gross sales. This figure should include the total sale price of each item sold without any deductions.

- On Line 2, disclose the total value of any tangible personal property acquired that is subject to use tax, ensuring it reflects the actual acquisition cost.

- Include gross receipts from rentals and services in Line 3, making sure to account for any taxable services as defined in Louisiana tax law.

- Follow the instructions for Lines 4 through 16, carefully filling in totals, deductions, and any applicable credits. Ensure to round amounts to the nearest dollar.

- Attach any necessary documentation to support your claims, such as invoices for any claimed tax credits.

- Review the form for accuracy and completeness. Once satisfied, sign and date the form as required on the designated lines.

- Choose your method for submitting the form. You can save your changes, download a copy, print it for mailing, or share it if needed.

Complete your Louisiana Department of Revenue forms online to ensure timely and accurate submissions.

Once you have filed, you can check the status of your refund using the following methods: Visit “Where's My Refund?” at .revenue.louisiana.gov/refund. Submit an Individual Refund Status email inquiry. Call 888-829-3071.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.