Loading

Get Or Tips For Pd100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Tips for PD100 online

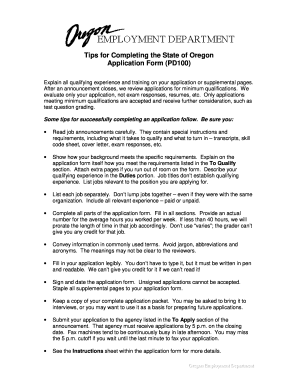

Completing the OR Tips for PD100 form effectively is essential for ensuring your application meets all necessary qualifications. This guide will provide a clear, step-by-step approach to successfully navigating the form online, enabling you to present your qualifications accurately and comprehensively.

Follow the steps to complete the OR Tips for PD100 form

- Click the ‘Get Form’ button to access the OR Tips for PD100 document and open it for completion.

- Carefully read through the job announcement to understand any special instructions and requirements, including necessary documents like transcripts or skill code sheets.

- Clearly explain how your background meets the qualifications listed in the To Qualify section of the application. Use the form to outline your relevant experience and duties; if more space is needed, attach supplemental pages.

- List each relevant job individually and avoid combining jobs, even if they are from the same employer. Include all types of experience, whether paid or volunteer.

- Ensure all sections of the application form are filled out completely. Provide a precise number of average hours worked weekly; do not use the term 'varies'.

- Use clear, commonly understood terms throughout the application. Refrain from using jargon, abbreviations, or acronyms that may confuse reviewers.

- Fill in your application neatly. It is acceptable to write by hand, but make sure it is legible. Illegible forms will not be credited.

- Include your signature and date on the application. Applications that are unsigned will be disqualified.

- Staple any additional pages securely to your application form.

- Retain a copy of your complete application packet for your records, as you may need it for interviews or future applications.

- Submit your application to the designated agency as listed in the To Apply section of the job announcement by 5 p.m. on the closing date. Avoid last-minute submissions to prevent missing the deadline.

- Refer to the Instructions sheet included within the application form for further details and guidance.

Start filling out your OR Tips for PD100 form online today!

Related links form

Tips are reported in box 7 because this box specifically reflects non-employee compensation. It helps the IRS track income that might otherwise be overlooked. Understanding the implications of OR Tips for PD100 can clarify why proper reporting in box 7 is vital for your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.