Loading

Get Canada T1136 E 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1136 E online

Filling out the Canada T1136 E form can seem overwhelming, but with a clear guide, you can navigate it smoothly. This document will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Canada T1136 E form.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

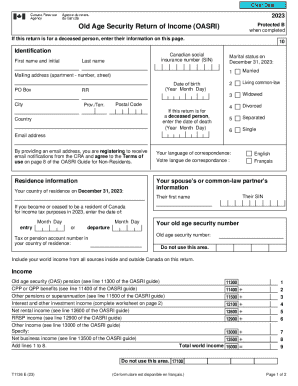

- Begin by entering identification information. Fill in the first name, middle initial, last name, mailing address, and date of birth. If this return is for a deceased person, include their date of death.

- Indicate your marital status as of December 31, 2023, by selecting one of the options provided, such as married, single, or separated.

- Provide your email address to register for notifications from the CRA and choose your preferred language of correspondence.

- Enter residence information, including your country of residence on December 31, 2023, and if applicable, your spouse's or partner's details including their SIN and first name.

- Report your world income. Carefully fill out the income section for Old Age Security, CPP or QPP benefits, and any other sources of income according to the instructions.

- If you have deductions, enter the applicable amounts for carrying charges and other deductions. Ensure to calculate your net world income accurately.

- Complete the refund or balance owing section by calculating any recovery tax, and determine if you have a refund or balance owing.

- In the signature section, certify that the information provided is accurate and complete. Include your date and telephone number.

- Finally, review your entire form for accuracy, then proceed to save changes, download, print, or share the completed form as needed.

Complete your Canada T1136 E form online today to ensure accurate filing and compliance.

As a rule, you can deduct a business investment loss on line 234 if you sustained losses in 2022 on investments (shares or debt securities) in a Canadian-controlled private corporation (that is, a corporation whose shares are not listed on a stock exchange).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.