Loading

Get Ttb F 5250.2 Chipra.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TTB F 5250.2 CHIPRA.doc online

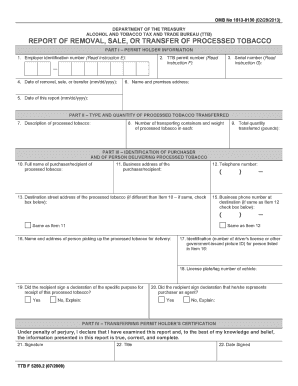

Filling out the TTB F 5250.2 CHIPRA form online can seem daunting, but with clear instructions, it becomes a straightforward task. This guide will walk you through each step to ensure you complete the form correctly and efficiently.

Follow the steps to fill out the form with ease.

- Click 'Get Form' button to obtain the form and open it in the digital environment.

- In item 1, enter your Employer Identification Number, which is the nine-digit code assigned to your business by the IRS.

- For item 2, provide your TTB permit number, which can be found on your TTB permit. Ensure you format it correctly, for example, 'MP-XX-1234' where XX is the state abbreviation.

- Assign a unique serial number in item 3, starting with '1' for your first report of the calendar year and numbering subsequent reports in chronological order.

- In item 4, indicate the date of the removal, sale, or transfer, and in item 5, enter the date of this report.

- In item 6, input your name and the premises address exactly as shown on your TTB permit.

- Complete item 7 with a description of the processed tobacco being reported, using specific descriptors such as 'loose cut rag tobacco.'

- For item 8, state the number of transport containers and the weight of tobacco in each, such as '20 boxes, 50 pounds each.'

- In item 9, calculate and enter the total quantity of processed tobacco transferred, stated in pounds.

- For items 10 to 20, provide the purchaser's or recipient's full name, business address, telephone number, and additional information as required.

- In the certification section, item 21, ensure the report is signed by the appropriate person as detailed in the instructions, based on the business structure.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your TTB F 5250.2 CHIPRA form online today for a seamless documentation process.

The federal government taxes tobacco products, including cigarettes, cigars, pipe tobacco, and roll-your-own tobacco. The federal excise tax on cigarettes is just over $1.00 per pack. Large cigars are taxed at 52.75 percent of the manufacturer's sales price, with a maximum tax of 40.26 cents per cigar.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.