Loading

Get (please Read Instructions Before Completing This Form) - Ttb Treas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the (Please Read Instructions Before Completing This Form) - Ttb Treas online

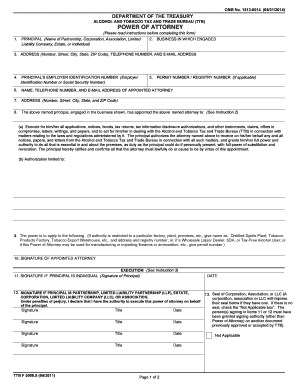

Filling out the (Please Read Instructions Before Completing This Form) - Ttb Treas is an essential step in authorizing someone to represent your interests before the Alcohol and Tobacco Tax and Trade Bureau (TTB). This guide will provide you with a clear, step-by-step approach to complete the form accurately and efficiently.

Follow the steps to complete your power of attorney form.

- Press the ‘Get Form’ button to access the power of attorney form and open it in the desired format.

- Fill in the principal's name, which may be a partnership, corporation, association, limited liability company, estate, or individual. Ensure that you provide the full and correct legal name.

- Indicate the business in which the principal is engaged by providing the appropriate title or description associated with the operations.

- Enter the principal's address, telephone number, and email address accurately. If a permit or registry number is applicable, include this information as well.

- Record the Principal's Employer Identification Number (EIN) or Social Security Number (SSN) in the designated section.

- Provide the name, telephone number, and email address of the appointed attorney who will represent the principal.

- Enter the attorney’s address, ensuring it is complete with street number, city, state, and ZIP code.

- Fully describe the powers granted to the attorney in paragraph 8(a) and, if necessary, specify any limitations in section 8(b). Be thorough to ensure proper authority.

- Detail any restrictions on the power of attorney in section 9, explaining the specific location or type of business if applicable.

- Have the appointed attorney sign the form where indicated to verify their acceptance of the power of attorney.

- If the principal is an individual, ensure they sign in the appropriate location. If the principal is a partnership, corporation, or similar, gather all required signatures and titles.

- If applicable, affix the corporate seal in section 13, or check the ‘Not Applicable’ box if there is no seal.

- Complete section 14 with acknowledgement, witnessing, or declaration as needed. Ensure signatures from witnesses or a notary if required.

- Once all information is accurately filled out, you can save your changes, download, print the form, or share it as necessary.

Complete your form online and ensure all the required information is filled out correctly to represent your interests effectively.

If you do not timely pay your taxes, you may have to pay a penalty of 1/2 of 1% of your unpaid taxes for each month or part of a month after the due date that the tax is not paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.