Loading

Get Form Hr-1040-x - 1998. Form Hr-1040-x - 1998 - Form And Instructions - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form HR-1040-X - 1998 - Form And Instructions - State Nj online

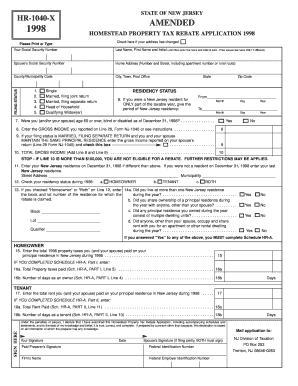

The Form HR-1040-X is essential for amending your Homestead Property Tax Rebate Application in New Jersey for the year 1998. This guide provides a systematic approach to filling out the form online, ensuring that you accurately complete each section for effective submission.

Follow the steps to effectively complete the Form HR-1040-X - 1998 online.

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred editor.

- In the identification section, print or type your last name first, followed by your first name and initial. Also include your spouse’s name if filing jointly.

- Provide your home address, including street number, city, county, and zip code, ensuring accuracy in your details.

- Choose your filing status by checking the box that corresponds to your situation: Single, Married Filing Joint, Married Filing Separate, Head of Household, or Qualifying Widow(er).

- Indicate your residency status by listing the period during which you were a resident of New Jersey in the appropriate lines.

- Answer the question regarding if you or your spouse were age 65 or older, blind, or disabled as of December 31, 1998. This will affect your eligibility.

- Report your gross income as indicated on Line 29 of Form NJ-1040. If not applicable, enter the income you would have reported.

- If married filing separately and living at the same address, report your spouse’s gross income as necessary.

- Calculate and enter the total gross income by adding your reported income with your spouse's if applicable.

- Proceed to provide details of your principal residence, including the block and lot number, which can be found on your property tax bill.

- Fill out the homeowner or tenant status section, checking the appropriate boxes as per your actual housing situation in 1998.

- Complete Schedule HR-A if you answered 'Yes' to any questions about multiple residences, owners, or tenants.

- Sign and date the form as required at the bottom, ensuring all necessary parties sign if applicable.

- Finally, review your completed form for accuracy before saving, downloading, or printing it for submission.

Complete your Form HR-1040-X online today to ensure your Homestead Property Tax Rebate is processed correctly.

File Form IL-1040-X, Amended Individual Income Tax Return, for tax years ending on December 31, 2021, and December 31, 2020, on MyTax Illinois. Use MyTax Illinois to electronically file your Amended Individual Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.