Loading

Get Business Personal Property Return 2015 - Hanover County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Personal Property Return 2015 - Hanover County online

This guide provides step-by-step instructions for completing the Business Personal Property Return 2015 for Hanover County online. By following these clear and supportive guidelines, users can efficiently navigate the form and ensure compliance with local tax regulations.

Follow the steps to complete your Business Personal Property Return online.

- Press the ‘Get Form’ button to access the Business Personal Property Return 2015 document. This will allow you to open the form in your preferred online document editor.

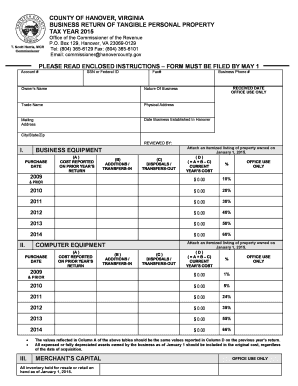

- Input your account number, business name, and Federal Identification Number (FEIN) or Social Security Number (SSN) at the top of the form.

- Provide your business contact information, including phone number, fax number, and the physical and mailing addresses.

- Fill in the date your business was established in Hanover County.

- In Section I, list all business equipment that was owned as of January 1, 2015. Enter the purchase date, cost from the prior year’s return, any additions or transfers-in, and disposals or transfers-out for each year. Ensure to attach a detailed itemized listing of all property.

- In Section II, complete details for computer equipment in the same format as Section I, ensuring that you include all owned computer hardware and peripheral equipment.

- In Section III, report the merchant’s capital by listing all inventory held for resale as of January 1, 2015.

- In Section IV, report machinery and tools used in applicable businesses by entering the original capitalized cost.

- In Section V, provide information on any leased equipment and vehicles by listing the name and address of the lessor, descriptions of leased items, lease ID numbers, rental amounts, and the beginning and ending date of each lease.

- In Section VI, ensure that the taxpayer signature and information are completed, including the name of the officer signing the return and a contact name for any inquiries.

- Finally, in Section VII, if you used a paid preparer, fill in their information and ensure they sign the form. Once all sections are complete, save your changes, and download or print the form for submission.

Complete your Business Personal Property Return online to ensure compliance and avoid late penalties.

Personal Property Tax Form FP-31 may be filed online by signing up for a MyTax.DC.gov account. Form FP-31 Instructions are available and include information on exemptions, due dates, payment options, and penalties and interest. This helpful User Guide will walk you through the process of filling out Form FP-31.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.