Get Nj-1040nr Form (1998). Filing Information For Nj-1040nr For 1998 - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ-1040NR Form (1998) online

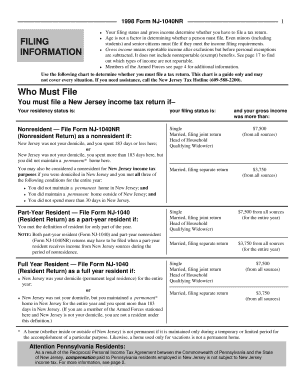

This guide provides step-by-step instructions on how to properly complete the NJ-1040NR Form for the tax year 1998. Designed for nonresidents, this form helps ensure compliance with New Jersey tax regulations while simplifying the filing process for all users.

Follow the steps to expertly navigate each section of the NJ-1040NR Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify your residency status and determine whether you need to file a tax return using the chart provided. Nonresidents must file Form NJ-1040NR if their gross income exceeds the specified limits.

- Complete the name, address, and social security number sections carefully. Double-check for accuracy either by using the label or entering this information manually.

- Select the correct filing status as per your federal tax return. Ensure that you check only one box that corresponds to your status.

- Fill in the exemptions section based on the number of exemptions you can claim for yourself and your dependents, if applicable. Make sure to prorate exemptions if you were a part-year resident.

- Report all sources of income in Part I of the form, separating your total income from both New Jersey sources and income from other areas. Ensure your entries reflect accurate figures.

- Calculate your taxable income by deducting exemptions, deductions, and any adjustments from your total income. Use the instructions for data on medical expenses, retirement income exclusions, and itemized deductions.

- Review the tax rate schedule for your filing status based on your taxable income. Calculate the total tax due using the appropriate methods or tables.

- Ensure that you report any New Jersey tax withheld from your income as indicated in the instructions. This will assist in any potential refunds.

- Finally, review all completed sections for errors, ensure all necessary forms are attached, sign, and date the return. You may choose to save, print, or share your form as required.

Complete your NJ-1040NR Form online today to streamline your filing process and avoid potential penalties.

ing to the Resident, Part-Year, and Nonresident filing instruction web-pages, you must file a return if: Your filing status is Single or Married Filing Separate AND your gross income was at least $10,000, OR. What are New Jersey's Filing Requirements? TaxSlayer https://support.taxslayer.com › en-us › articles › 360015... TaxSlayer https://support.taxslayer.com › en-us › articles › 360015...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.