Loading

Get Filing Information Who Must File - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FILING INFORMATION Who Must File - State Of New Jersey - State NJ online

Filling out the FILING INFORMATION Who Must File for New Jersey is essential for determining your tax obligations. This guide provides clear, step-by-step instructions to aid users of all experience levels in completing the form correctly.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

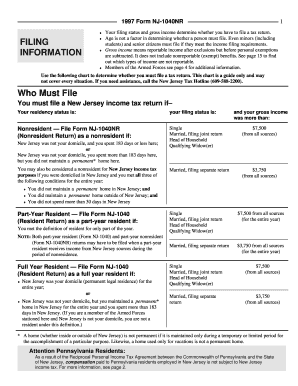

- Review the residency status options carefully. Determine if you are a nonresident, part-year resident, or full-year resident based on your living situation and duration in New Jersey.

- Identify your filing status. Select the correct status from the options provided: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Refer to the income thresholds for each status. Ensure that your total gross income exceeds the minimum level that requires you to file.

- For each income category, enter the appropriate amounts based on whether they are from New Jersey sources or elsewhere.

- Complete the exemptions sections. Indicate if you or your spouse qualify for additional exemptions due to age or disability.

- Attach necessary documentation such as W-2 forms and any other relevant income statements.

- After completing the form, review all entries for accuracy. Check for correct social security numbers, names, and addresses.

- Sign and date your return as required. Remember, both partners must sign if filing jointly.

- Submit your completed form through the appropriate submission method, keeping records of all documents and submissions.

Start completing your New Jersey tax documents online today.

Your filing status is Single or Married Filing Separate AND your gross income was at least $10,000, OR. Your filing status is Married Filing Joint, Head of Household, or Qualifying Widow(er) AND your gross income was at least $20,000. What are New Jersey's Filing Requirements? TaxSlayer https://support.taxslayer.com › en-us › articles › 360015... TaxSlayer https://support.taxslayer.com › en-us › articles › 360015...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.