Loading

Get Form Da185.4a2 21 December 2012 - Sars

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form DA185.4A2 21 December 2012 - SARS online

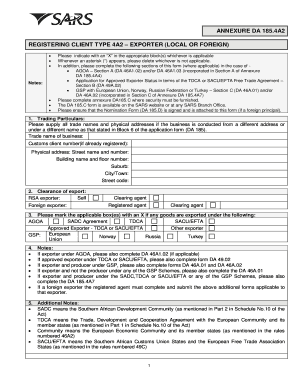

Filling out the Form DA185.4A2 is an essential step for exporters seeking to register with the South African Revenue Service. This guide will provide you with clear, step-by-step instructions to ensure a smooth process and accurate submission.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by filling in the trading particulars in the first section. Provide all trade names and physical addresses, ensuring they match your business records. This includes the trade name, customs client number (if already registered), and full physical address.

- In the clearance of export section, indicate whether the exporter is self, an RSA exporter, a foreign exporter, or a clearing agent by selecting the appropriate box.

- Mark any applicable agreements you are a part of in the goods exported section. Use an X to indicate if you are exporting under SADC, TDCA, SACU/EFTA, AGOA, or other agreements.

- Complete the authority to apply section by providing the name of the applicant and their capacity. Ensure that the information provided is accurate, and check the relevant box corresponding to the authorization type.

- In the declaration section, affirm that the particulars in the application are true and correct. Here, you will also provide your initials, surname, status, signature, and date & place.

- If applicable, complete additional sections for the African Growth and Opportunity Act (AGOA), or for other agreements based on the context of your export. Ensure to attach any necessary annexures where required.

- Review all sections of the form to ensure accuracy and completeness before proceeding.

- Finalize your submission by saving changes, downloading the filled form, printing a copy for your records, or sharing it as needed.

Start completing your Form DA185.4A2 online today!

All exporters need to be registered at SARS Customs as an exporter. When registered you get an 8 digit code often referred to as your export license, CCN or export customs code. Customs uses this code to track all your exports and ensure that your duties are paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.