Loading

Get Tax Collection Administration Tax Collection Procedures

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAX COLLECTION ADMINISTRATION TAX COLLECTION PROCEDURES online

This guide will provide a clear and supportive overview of the steps necessary to fill out the TAX COLLECTION ADMINISTRATION TAX COLLECTION PROCEDURES form online. Whether you are familiar with tax processes or a first-time user, this guide aims to simplify the procedure for you.

Follow the steps to efficiently complete the tax collection procedures form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your municipality information, including the name, county, and any specific identification numbers related to the tax collection. This ensures accurate record-keeping.

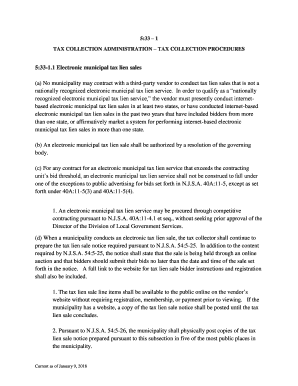

- Fill out the fields regarding the electronic municipal tax lien sales. Include details about the vendor conducting the sales, ensuring they meet the qualifications outlined for a nationally recognized service.

- Provide necessary resolutions and approvals from your governing body, as required for the electronic municipal tax lien sale. Ensure all corresponding documents are uploaded if the system allows.

- Complete the sections regarding notifications. Ensure to fill in details for how the tax lien sale notice will be communicated to property owners, including both public postings and any mailings.

- Review the bidding and registration requirements for bidders. Enter the necessary specifics about the online registration process, including details on any deposits required.

- Make sure to include the cybersecurity measures in place, as well as procedures for handling tax payments. This is critical for ensuring compliance and protecting user data.

- Once all fields are completed and reviewed, proceed to save your changes. You may have options to download, print, or share the form for your records.

Complete your documents online today to ensure a smooth tax collection process.

Federal taxes are collected by the Canada Revenue Agency (CRA). Under tax collection agreements, the CRA collects and remits to the provinces: provincial personal income taxes on behalf of all provinces except Quebec, through a system of unified tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.