Get Tt Tatil Know Your Customer (kyc) Due Diligence Compliance Checklist For Corporate Clients 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TT Tatil Know Your Customer (KYC) Due Diligence Compliance Checklist For Corporate Clients online

Completing the TT Tatil Know Your Customer (KYC) Due Diligence Compliance Checklist for corporate clients is a crucial step in ensuring compliance with financial regulations. This guide will provide clear, step-by-step instructions on how to effectively fill out the form online, ensuring all necessary information is accurately captured.

Follow the steps to complete the checklist seamlessly.

- Click the ‘Get Form’ button to access the checklist. This action will allow you to obtain the document and open it in an editable format.

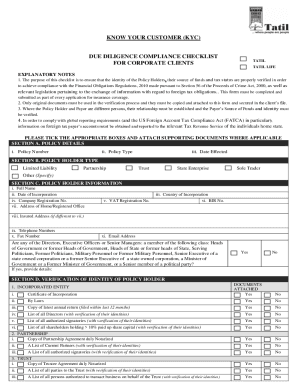

- Begin with Section A, where you will enter the policy details. Fill in the policy number, policy type, and the date the policy was effected.

- Proceed to Section B to indicate the type of policy holder by selecting one of the options: Limited Liability, Partnership, Trust, State Enterprise, Sole Trader, or Other. Specify if you choose ‘Other’.

- In Section C, provide detailed information about the policy holder. This includes the full name, date of incorporation, company registration number, address of the registered office, VAT registration number, BIR number, and contact details such as telephone numbers, fax number, and email address.

- Ensure you address the question regarding any directors or senior managers associated with specific government roles by indicating ‘Yes’ or ‘No,’ and provide detailed information if applicable.

- Move to Section D for verification of identity. Depending on the type of entity (Incorporated Entity, Partnership, Trust, or Sole Trader), attach the required documents such as certificate of incorporation, partnership agreement, trustee agreement, or other identity verification materials marked as 'Yes' or 'No.'

- In Section E, assess whether any shareholders possess more than 10% participation in the entity and indicate if any foreign indicia applies. Follow instructions to gather and attach necessary documentation related to foreign tax obligations.

- Fill out Section F by specifying the type of business activities. Tick the applicable boxes and provide further details as needed.

- In Section G, disclose the source of funds of the policy holder. Provide annual turnover information and attach the necessary documents for verification.

- Finally, in Section H, ensure that the signature section is duly completed by an authorized signatory. This includes signing off on the accuracy of statements and consenting to information disclosure. Also, have a TATIL employee acknowledge the signing.

- Once all sections are completed, save your changes, and back up your information. You may download, print, or share the final document as needed.

Start filling out your TT Tatil KYC checklist online today to ensure compliance and accuracy.

Customer due diligence (CDD) is the act of performing background checks and other screening on the customer to ensure that they are properly risk-assessed before being onboarded. CDD is at the heart of Anti-Money Laundering (AML) and Know Your Customer (KYC) initiatives. What Is Customer Due Diligence? | Jumio jumio.com https://.jumio.com › cdd-customer-due-diligence jumio.com https://.jumio.com › cdd-customer-due-diligence

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.