Loading

Get Application For Approval - Hud

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Approval - HUD online

Filling out the Application For Approval - HUD online is an essential process for lenders seeking approval to participate in FHA programs. This guide provides clear, step-by-step instructions tailored to help users efficiently complete the form.

Follow the steps to complete the Application For Approval - HUD.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

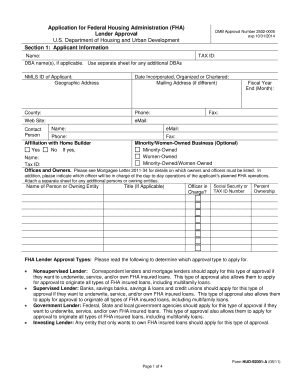

- In Section 1, provide the applicant's information, including the name, tax ID, geographic address, mailing address (if different), phone number, website, and email address. Ensure all fields are filled accurately.

- Designate a contact person by filling out their name, phone number, and affiliation with a home builder, if applicable.

- Indicate whether the applicant is a Minority or Women-Owned Business by checking the appropriate boxes.

- List the owners and officers in the designated area, providing details such as names, titles, social security numbers, and ownership percentages. Attach a separate sheet for additional persons or entities.

- Select the FHA lender approval type that applies to your organization from the options provided: Nonsupervised Lender, Supervised Lender, Government Lender, or Investing Lender.

- In Section 2, indicate the FHA loan programs and lender functions your organization wishes to participate in, such as single-family or multifamily loans.

- In Section 3, review each certification and acknowledgment statement. Check 'Yes' or 'No' as appropriate, and provide detailed explanations for any 'No' responses on company letterhead.

- Complete the signature section by entering the name and title of the applicant's representative who is submitting the form, along with their signature and the date.

- Once the form is filled out completely, you can save changes, download a copy for your records, print it for submission, or share it as needed.

Begin the application process online by filling out the Application For Approval - HUD now.

Usually, the FHA loan process takes anywhere between 30 – 60 days. However, appraisal problems can prolong this timeline. The FHA allows up to 120 days for necessary repairs to be made.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.