Loading

Get Ak Tq01c 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK TQ01C online

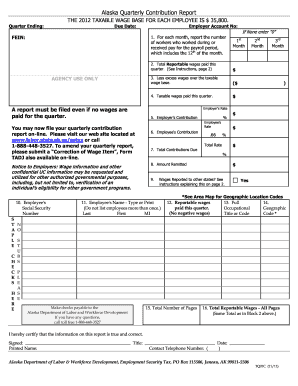

Filling out the AK TQ01C online can seem daunting, but this guide will assist you in completing it with confidence. By following these clear instructions, you will be able to effectively report your quarterly contributions.

Follow the steps to successfully complete your AK TQ01C form.

- Press the ‘Get Form’ button to obtain the form and open it in the suitable editor.

- Enter the quarter ending date in the designated field at the top of the form.

- Provide the due date for the contribution report. This is generally set by the employer’s payroll schedule.

- Fill in the Federal Employer Identification Number (FEIN). This is a unique number assigned to your business for tax purposes.

- Provide your employer account number, which is issued by the state.

- For each month, report the number of workers who worked during or received pay for the payroll period, which includes the 12th of the month. If there are no workers, enter '0'.

- Total the reportable wages paid during the quarter. This total should be based on all wage amounts, even if no wages are paid.

- Deduct any excess wages over the taxable wage base from the total wages and report the result as taxable wages paid this quarter.

- Enter the employer's contribution rate and calculated contributions due based on taxable wages.

- Similar to the employer’s contribution, report the employee’s contribution based on the specified employee rate.

- Sum up the total contributions due and include the amount remitted.

- Indicate if wage information was reported to other states as per the provided instructions.

- Complete the certification at the end of the form. Sign with your name, title, date, and contact telephone number.

- Count the total number of pages included in your report and put that number in the field provided.

- Finally, review all entries for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Complete your AK TQ01C form online today for a streamlined reporting experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Absolutely, Form F 1065 can be filed electronically, simplifying the submission process for taxpayers. It's important to follow the guidelines to ensure that your filing meets the AK TQ01C standards. Using the US Legal Forms platform can enhance your understanding of electronic filing, providing an easy-to-navigate solution.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.