Loading

Get Ky Form Np - City Of Henderson 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form NP - City of Henderson online

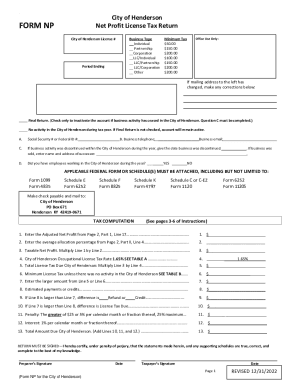

Filling out the KY Form NP is essential for businesses operating in the City of Henderson to report income and pay the necessary taxes. This guide provides step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to accurately complete the KY Form NP online.

- Click ‘Get Form’ button to access the KY Form NP and open it in your chosen online editor.

- Locate the 'City of Henderson License #' field. Enter the assigned license number associated with your business.

- In the 'Period Ending' section, input the date covering the reporting period for which you are filing the form.

- Select your business type by checking the appropriate box: Individual, Partnership, Corporation, LLC/Individual, LLC/Partnership, LLC/Corporation, or Other.

- If your mailing address has changed, please note the corrections in the designated area.

- For those indicating a final return, check the box provided and ensure to complete Question C if business activity has ceased.

- Provide your Social Security Number or Federal ID in section A, followed by your business telephone and email address in section B.

- If applicable, indicate the date your business activity was discontinued and provide the name and address of the successor.

- Answer whether you had employees working in the City of Henderson by checking YES or NO.

- Complete the tax computation section by entering figures in the designated fields, including your adjusted net profit, allocation percentage, taxable net profit, and total license tax due.

- Ensure to calculate any applicable penalties or interest, and sum these to find the total amount due.

- Lastly, the form must be signed by both the preparer and taxpayer, along with the respective dates.

- Once all information is accurately filled, save your changes, download, print, or share the completed form as needed.

Start completing your forms online today to ensure timely compliance with local regulations.

City Net Profits Every business entity conducting business in the City of Henderson for a profit is required to pay a tax on its net profits. Calendar year filers with a year end of December 31, 2022 pay a tax of 1.49% on net profits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.