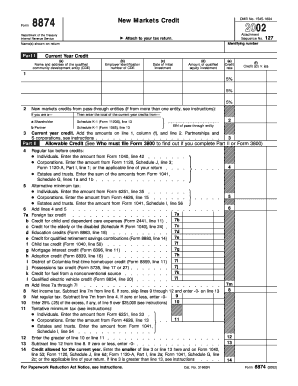

Get 2002 Form 8874. New Markets Credit - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2002 Form 8874. New Markets Credit - Irs online

How to fill out and sign 2002 Form 8874. New Markets Credit - Irs online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The days of terrifying complex tax and legal documents have ended. With US Legal Forms the entire process of filling out legal documents is anxiety-free. The best editor is directly close at hand supplying you with various beneficial tools for completing a 2002 Form 8874. New Markets Credit - Irs. These guidelines, combined with the editor will help you through the whole process.

- Click the orange Get Form option to begin filling out.

- Turn on the Wizard mode on the top toolbar to get more recommendations.

- Fill in every fillable area.

- Make sure the information you add to the 2002 Form 8874. New Markets Credit - Irs is up-to-date and accurate.

- Add the date to the document using the Date tool.

- Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one.

- Make sure that each field has been filled in properly.

- Click Done in the top right corne to save and send or download the form. There are several options for receiving the doc. An attachment in an email or through the mail as a hard copy, as an instant download.

We make completing any 2002 Form 8874. New Markets Credit - Irs much faster. Start now!

How to edit 2002 Form 8874. New Markets Credit - Irs: customize forms online

Sign and share 2002 Form 8874. New Markets Credit - Irs along with any other business and personal paperwork online without wasting time and resources on printing and postal delivery. Take the most out of our online form editor using a built-in compliant eSignature tool.

Approving and submitting 2002 Form 8874. New Markets Credit - Irs templates electronically is quicker and more efficient than managing them on paper. However, it requires making use of online solutions that ensure a high level of data security and provide you with a certified tool for generating eSignatures. Our powerful online editor is just the one you need to complete your 2002 Form 8874. New Markets Credit - Irs and other individual and business or tax forms in an accurate and appropriate manner in line with all the requirements. It offers all the essential tools to easily and quickly fill out, edit, and sign documentation online and add Signature fields for other people, specifying who and where should sign.

It takes only a few simple steps to complete and sign 2002 Form 8874. New Markets Credit - Irs online:

- Open the chosen file for further managing.

- Use the upper panel to add Text, Initials, Image, Check, and Cross marks to your template.

- Underline the important details and blackout or remove the sensitive ones if required.

- Click on the Sign tool above and choose how you prefer to eSign your sample.

- Draw your signature, type it, upload its image, or use another option that suits you.

- Move to the Edit Fillable Fileds panel and drop Signature areas for other people.

- Click on Add Signer and type in your recipient’s email to assign this field to them.

- Make sure that all information provided is complete and correct before you click Done.

- Share your paperwork with others utilizing one of the available options.

When approving 2002 Form 8874. New Markets Credit - Irs with our powerful online solution, you can always be sure to get it legally binding and court-admissible. Prepare and submit documentation in the most efficient way possible!

NMTC loans have more favorable terms than traditional debt and are interest only for seven years. Principal payments on the NMTC loans are prohibited during the seven-year period. Moreover, a portion of the NMTC loan or loans received may be forgiven prior to any principal payment requirements begin.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.