Loading

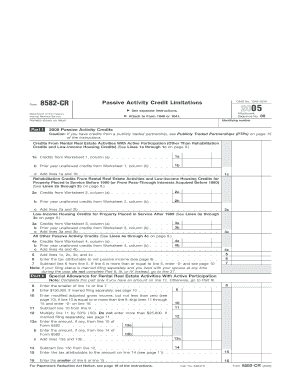

Get 2005 Form 8582-cr (fill-in Capable). Passive Activity Credit Limitations - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Form 8582-CR (Fill-In Capable). Passive Activity Credit Limitations - IRS online

The 2005 Form 8582-CR is essential for individuals and entities claiming passive activity credits. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently, ensuring compliance with IRS regulations.

Follow the steps to complete the 2005 Form 8582-CR online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering your name(s) and identifying number at the top of the form. This information should match what is shown on your tax return.

- In Part I, report credits from rental real estate activities with active participation. Fill out lines 1a to 1c by adding credits from the relevant worksheets provided.

- Continue to lines 2a to 2c to report rehabilitation credits and low-income housing credits from properties placed in service before 1990.

- For low-income housing credits for properties placed in service after 1989, complete lines 3a to 3c by adding the appropriate worksheet credits.

- On lines 4a to 4c, report any other passive activity credits, ensuring to combine prior unallowed credits where necessary.

- Line 5 requires you to add the totals from lines 1c, 2c, 3c, and 4c.

- Enter the tax attributable to net passive income on line 6 and then perform the subtraction as indicated on line 7, adjusting your values based on IRS instructions.

- Proceed to Part II if applicable. If you have an amount on line 1c, follow the steps to calculate the special allowance for rental real estate activities.

- Complete any necessary calculations in Part III regarding rehabilitation credits, using lines 17 to 30.

- Complete Part IV if you are claiming low-income housing credits, making the required calculations on lines 31 to 36.

- In Part V, add the total allowed credits from lines 6, 16, 30, and 36 to determine the final passive activity credit allowed.

- Lastly, review all entries for accuracy before saving, downloading, or printing the completed form.

Complete your IRS forms online with confidence to ensure timely and accurate submissions.

Generally, the passive activity credit for the tax year is disallowed. The passive activity credit is the amount by which the sum of all your credits subject to the passive activity rules exceed your regular tax liability allocable to all passive activities for the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.