Loading

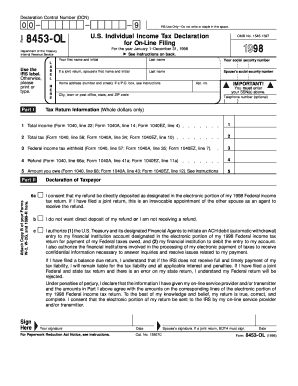

Get 1998 Form 8453-ol. U.s. Individual Income Tax Declaration For On-line Filing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1998 Form 8453-OL. U.S. Individual Income Tax Declaration For On-Line Filing online

Filling out the 1998 Form 8453-OL is a critical step in the online filing process of your U.S. Individual Income Tax Return. This form is essential for authenticating your tax return and ensuring all necessary information is accurately transmitted to the IRS.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the top left corner, type or print the Declaration Control Number (DCN), a 14-digit number assigned by your online service provider.

- Fill in your personal information in Part I, including your first name, last name, and Social Security number. If applicable, also include your spouse's information.

- Complete the home address section. Ensure to provide your apartment number if applicable and verify that the address matches the electronically filed return.

- Enter your total income, total tax, federal income tax withheld, refund amount, and any amount you owe from the corresponding lines on your tax return.

- In Part II, indicate whether you consent to direct deposit your refund, do not want direct deposit, or authorize an ACH debit for tax payments by checking the appropriate box.

- If applicable, attach Copy B of your Forms W-2, W-2G, and 1099-R to the form as instructed.

- Sign and date the form. If filing jointly, ensure your spouse also signs and dates the form.

- Submit the signed Form 8453-OL to the IRS by mailing it to the appropriate address indicated in your acknowledgment message from your online service provider.

- After submitting, ensure changes are saved, and consider downloading or printing the completed form for your records.

Complete your documents online to ensure timely and accurate tax filing.

If you are e-filing your City of Detroit return separately from your federal or state return you must sign your return by either: Complete Form MI-8453, Michigan Individual Income Tax Declaration, or. Retained a copy for six years. Do not mail Form MI-8453 to Treasury.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.