Loading

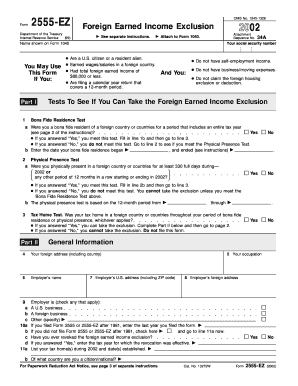

Get F2555ez 2002 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F2555ez 2002 Form online

Filling out the F2555ez 2002 Form can seem challenging, but this guide will walk you through each step of the process online. This form helps U.S. citizens and resident aliens claim the foreign earned income exclusion, simplifying your tax filing experience.

Follow the steps to successfully fill out the F2555ez 2002 Form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred format.

- Begin by entering your name as shown on Form 1040 in the designated field.

- Provide your social security number in the corresponding line to verify your identity.

- Check the eligibility criteria listed to ensure you qualify to use this form, confirming that your foreign earned income does not exceed $80,000.

- Complete Part I by answering the Bona Fide Residence Test and the Physical Presence Test questions. Select 'Yes' or 'No' and provide any necessary dates where indicated.

- Proceed to fill in your foreign address and employer details in Part II, including the employer's name and addresses.

- If applicable, indicate any prior filings of Form 2555 or 2555-EZ and note if you have ever revoked the foreign earned income exclusion.

- In Part III, if you were present in the United States during 2002, complete the days present information and income earned on business.

- Calculate your foreign earned income exclusion in Part IV, following the listed instructions to determine your maximum exclusion and fill in the associated amounts.

- Finally, review the completed form for accuracy, then save any changes you have made, download, print, or share the form as needed.

Navigate your tax filing with confidence by completing the F2555ez 2002 Form online today.

You need to complete Form 2555 (or Form 2555-EZ if you don't claim the housing deduction) and file it with your form 1040. It will allow you to exclude up to $108,700 of your foreign earned income from your taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.