Loading

Get Instructions For Form 1042 (2018)internal Revenue Service - ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Form 1042 (2018) Internal Revenue Service online

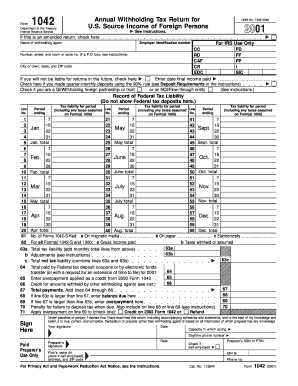

Filling out Form 1042 is an essential task for U.S. withholding agents reporting tax withheld on certain income of foreign entities. This guide provides a clear and supportive approach to help users complete the form online with confidence.

Follow the steps to successfully complete Form 1042 online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editing tool.

- In the first section, enter the name of the withholding agent and the employer identification number (EIN). Ensure accurate information as this is vital for your filing.

- Specify your address, including number, street, and room or suite number if applicable. If using a P.O. box, refer to the accompanying instructions for guidance.

- Indicate if this is an amended return by checking the appropriate box if applicable.

- Complete the 'Record of Federal Tax Liability' by entering the tax liabilities for each specified period as instructed.

- In the section for Forms 1042-S filed, provide the number of Forms submitted in both magnetic media and paper formats.

- Review the calculation sections for total tax liability, adjustments, and any payments made to avoid discrepancies.

- At the end of the form, ensure all fields are correctly filled and sign where indicated. If using a preparer, include their signature and details.

- Once complete, you can save the changes, download the document, print it, or share it as necessary.

Begin filling out your Form 1042 online today for a smoother process.

That has changed and, in fact, e-filing is set to become a requirement. In February 2023, new regulations were issued requiring certain taxpayers to file Forms 1042 electronically through the IRS' Modernized e-File (MeF) system beginning in 2024 (i.e., Tax Year 2023 Forms).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.