Loading

Get 1998 Form 1040a (schedule 3). Credit For The Elderly Or The Disabled For Form 1040a Filers - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 1040A (Schedule 3). Credit for the elderly or the disabled for Form 1040A filers - IRS online

This guide aims to assist users in accurately filling out the 1998 Form 1040A (Schedule 3) for claiming credit for the elderly or the disabled. By following these steps, users can effectively complete the form and potentially reduce their tax burden.

Follow the steps to successfully complete the 1998 Form 1040A (Schedule 3)

- Click ‘Get Form’ button to access and open the form in your preferred document editor.

- Enter your name and social security number as they appear on Form 1040A at the top of the form.

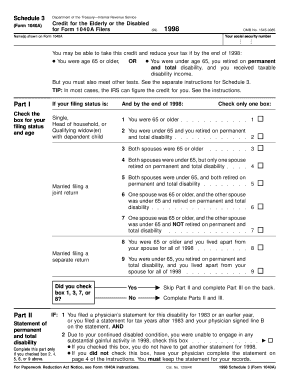

- Review the eligibility criteria: By the end of 1998, determine if you were age 65 or older, or under age 65 and retired on permanent and total disability, and receiving taxable disability income.

- In Part I, check the appropriate box corresponding to your filing status and age. Follow the instructions carefully to ensure accurate selection.

- If prompted, skip Part II if you checked boxes 1, 3, 7, or 8; otherwise, you need to complete it based on the physician’s statement requirements.

- Proceed to Part III to calculate your credit based on the boxes checked in Part I. Reference the corresponding dollar amounts given in the instructions for each selection.

- Complete line 11 if required, and enter your taxable disability income in line 12 as instructed.

- Calculate the figures as required in lines 13 through 20, ensuring to include any nontaxable income as instructed.

- After completing all required lines, save your changes, and prepare the form for downloading or printing as needed.

Complete your tax documents online with ease and ensure you take advantage of available credits.

Schedule 1 is where you report all your income that wasn't from bank interest, investment dividends, or wages reported on a W-2 from your employer. The “adjustments to income” section helps you find your AGI, which determines eligibility for other deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.