Loading

Get 1994 Form 1040a (schedule 2). Child And Dependent Care Expenses For Form 1040a Filers - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1994 Form 1040A (Schedule 2). Child and dependent care expenses for Form 1040A filers - IRS online

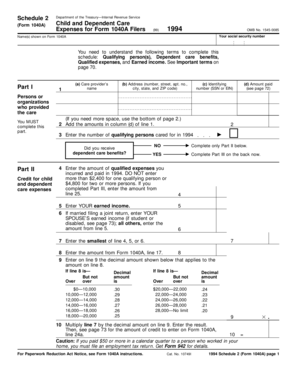

This guide provides a step-by-step approach to completing the 1994 Form 1040A, Schedule 2, which addresses child and dependent care expenses for filers. Understanding the components of this form is essential for effectively reporting your dependent care expenses and maximizing your potential credits.

Follow the steps to accurately complete your Form 1040A Schedule 2.

- Press the ‘Get Form’ button to obtain the form and display it in your preferred document viewer.

- Fill in your social security number and the name(s) as they appear on Form 1040A at the top of the form.

- In Part I, list the care provider's name, address, and identifying number. Record the amount paid in the respective fields.

- Add the amounts from column (d) of line 1 and input the total in line 2 to assess your credit for child and dependent care expenses.

- Indicate the number of qualifying persons cared for in 1994 on line 3. Check 'YES' or 'NO' to confirm if you received dependent care benefits.

- If you answered 'NO,' proceed to Part II. If 'YES', continue to Part III on the back of the form.

- In Part II, enter the amount of qualified expenses in line 4, adhering to the maximum stipulations for qualifying persons. Document your earned income in line 5 and your spouse’s earned income in line 6 if applicable.

- Determine the smallest figure among lines 4, 5, or 6 and enter it in line 7.

- Transfer the amount from Form 1040A, line 17, to line 8 and find the corresponding decimal amount based on your line 8 entry for line 9.

- Multiply the value from line 7 by the decimal on line 9 and document the result on line 10.

- In Part III, if applicable, enter the total dependent care benefits received in line 11 and the amount forfeited, if any, in line 12.

- Complete lines 13 through 20 by entering the necessary figures regarding earned income and benefits to determine taxable benefits.

- Finally, complete lines 21 through 25 to calculate your qualified expenses and the applicable credit amount. Transfer the final credit amount to line 4 on the front of this schedule.

- After filling out the form, save your changes electronically, and consider downloading, printing, or sharing the form as needed.

Start filling out your documents online to ensure you receive the tax credits you qualify for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.