Loading

Get Exclusion Of Income From The International

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exclusion Of Income From The International online

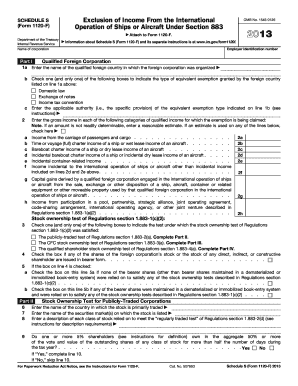

The Exclusion Of Income From The International form is essential for qualified foreign corporations seeking tax exemptions under specific international agreements. This guide provides clear instructions on how to fill out the form accurately and efficiently, ensuring compliance with tax regulations.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the Exclusion Of Income From The International and open it in an editor.

- Enter the name of the corporation and the employer identification number in the designated fields.

- In Part I, line 1a, provide the name of the qualified foreign country where the corporation was organized. On line 1b, check the box that corresponds to the type of equivalent exemption granted by that foreign country.

- For line 1c, specify the applicable authority or specific provision of the equivalent exemption type you indicated on line 1b.

- On lines 2a through 2h, enter the gross income for each category of qualified income for which the exemption is being claimed. If you're unsure of an amount, enter a reasonable estimate and check the appropriate box.

- In Part II, indicate which stock ownership test applies for publicly-traded corporations on line 3, checking the appropriate box.

- Complete the necessary details on lines 6 through 10, providing information on the country where the stock is traded and specifics about any class of stock that meets the requirements.

- For Part III regarding Controlled Foreign Corporations, fill out lines 11a through 14, providing ownership percentages and confirming whether the CFC is directly held by qualified U.S. persons.

- In Part IV, confirm ownership and enter the required percentages and totals as indicated in the fields.

- Once all sections are completed, ensure to review your entries. Users can then save changes, download, print, or share the form as necessary.

Complete your documents online to ensure accurate and efficient submission.

How Many Days Can You Be in the U.S. Without Paying Taxes? The IRS considers you a U.S. resident if you were physically present in the U.S. on at least 31 days of the current year and 183 days during a three-year period. The three-year period consists of the current year and the prior two years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.