Loading

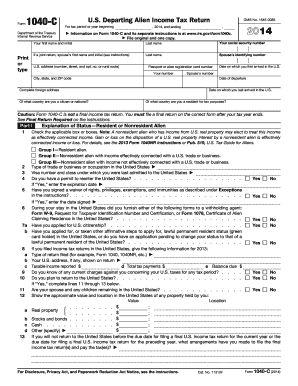

Get Form 1040-c (rev. 2009) - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1040-C (Rev. 2009) - IRS online

Filling out Form 1040-C is essential for departing aliens to report their income tax appropriately. This guide will provide you with clear, step-by-step instructions to complete the form online confidently.

Follow the steps to fill out the Form 1040-C effectively.

- Press the ‘Get Form’ button to access and open the form in your preferred editor.

- Enter your first name, middle initial, last name, and social security number in the respective fields. If you are filing jointly, include your spouse’s information as well.

- Provide your U.S. address, including your city, state, and ZIP code. Additionally, fill in your passport or alien registration card number.

- Complete the section regarding your immigration. Include dates for your arrival and departure from the U.S., as well as your citizenship and residency information.

- In Part I, check the boxes that correspond to your status as a resident or nonresident alien. Fill in any necessary information regarding your trade or business in the U.S.

- Proceed to Part II for exemptions. Check applicable boxes for yourself and your spouse, and list any dependents.

- In Part III, calculate your income tax. Enter totals in each field as specified, including deductions and exemptions.

- Finally, review the completed form for accuracy, then save changes. You may download, print, or share the form as needed.

Start filling out your Form 1040-C online today to ensure compliance and ease in managing your tax returns.

In these circumstances you normally have four years from the end of the tax year when you want to make the claim to actually make the claim for losses. Therefore, a claim for a loss arising in the tax year which ended on 5 April 2024 would have to be made by 5 April 2028.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.