Get 2015 It 2663 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 IT 2663 form online

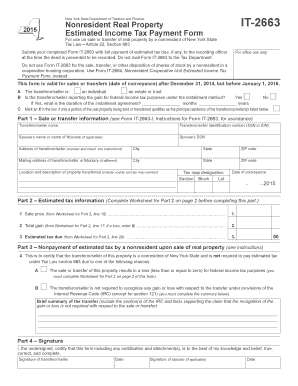

Filling out the 2015 IT 2663 form, used for estimated income tax payments related to the sale or transfer of real property by a nonresident of New York State, can be straightforward with the right guidance. This guide provides clear, step-by-step instructions to help you navigate and complete the form effectively.

Follow the steps to successfully fill out the 2015 IT 2663 form online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering the transferor/seller information in Part 1. Include the name, identification number, any applicable spouse or fiduciary names, and addresses. Ensure that the transferor/seller's details are accurate.

- Proceed to Part 2, where you will require the completed Worksheet for Part 2. Input the sale price and total gain based on your calculations from the worksheet.

- In Part 3, certify the nonpayment of estimated tax by marking the relevant checkbox and providing the required explanations when necessary.

- Complete Part 4 by providing signatures and dates for the transferor/seller and any applicable spouse before finalizing your submission.

- Once all fields have been filled appropriately, save your changes. You can then download, print, or share the completed form as needed.

Take the next step and complete your 2015 IT 2663 form online today.

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Tax Forms and Publications | Internal Revenue Service irs.gov https://.irs.gov › individuals › tax-forms-and-public... irs.gov https://.irs.gov › individuals › tax-forms-and-public...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.