Loading

Get St3, Certificate Of Exemption - Minnesota Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST3, Certificate Of Exemption - Minnesota Department Of Revenue online

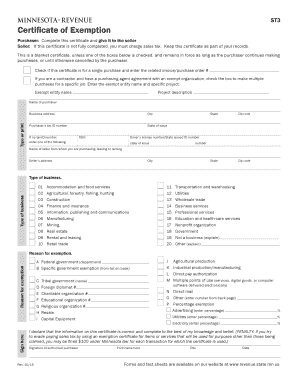

The ST3, Certificate of Exemption, is an important document for users wishing to claim sales tax exemptions on purchases made in Minnesota. This guide will walk you through each section of the form to ensure you complete it correctly and efficiently online.

Follow the steps to complete the ST3 form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In the first section, complete the name of the purchaser. This should include the official business name if applicable. Provide your business address, including city, state, and zip code.

- Enter the purchaser's tax ID number. If a tax ID is not available, provide the Federal Employer Identification Number (FEIN) or a state-issued identification number.

- Fill in the seller's name and address from whom you are purchasing, leasing, or renting. This part is crucial for verifying the transaction.

- Select the type of business from the provided list, indicating the relevant industry sector that applies to the seller.

- In the reason for exemption section, check the appropriate box that describes your exemption. Make sure to specify additional details if required, such as the name of a tribal government or number issued to a foreign diplomat.

- Sign the certificate as the authorized purchaser, providing your printed name, title, and the date of signing.

- Review all entries for accuracy and completeness. Once satisfied, you can save your changes, download the completed form, or print it for your records.

Complete your ST3, Certificate of Exemption online today to ensure you take advantage of your sales tax exemptions.

Tax-exempt goods Examples include most grocery items, feminine hygiene products, and medical supplies. We recommend businesses review the laws and rules put forth by the Minnesota Department of Revenue to stay up to date on which goods are taxable and which are exempt, and under what conditions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.