Loading

Get Colorado Withholding Tax 2015 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Colorado Withholding Tax 2015 Form online

This guide provides clear and supportive instructions on completing the Colorado Withholding Tax 2015 Form online. It aims to assist users, regardless of their experience level, in successfully navigating this document for accurate tax reporting.

Follow the steps to complete the Colorado Withholding Tax 2015 Form online

- Click the ‘Get Form’ button to access the Colorado Withholding Tax 2015 Form and open it in your preferred editor.

- Locate the account number field and enter the 8-digit Colorado business account number from your withholding certificate or sales tax license. Ensure not to use your FEIN or EFT number.

- In the filing period section, indicate the correct period for this return using the defined filing frequency.

- For line 1, enter the total Colorado income tax withheld for the indicated period. If there is no amount to report, ensure to file a zero return electronically.

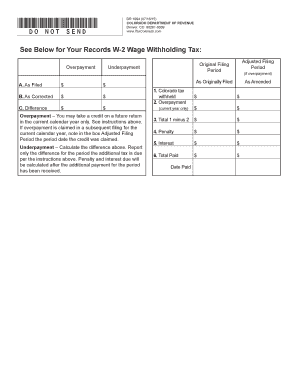

- If you are claiming an overpayment from a previous period, complete the worksheet provided and calculate the overpayment. Enter this amount on line 2.

- To find the net amount due, subtract line 2 from line 1 and enter this value on line 3.

- If applicable, complete lines 4 and 5 for penalties and interest if the return is being filed after the due date.

- Total lines 3, 4, and 5, and enter this amount on line 6 as the total amount due.

- Provide your signature and the date at the end of the form, confirming the accuracy of the information provided.

- Finally, save your changes; you can download, print, or share the form as necessary.

Complete your Colorado Withholding Tax 2015 Form online to ensure compliance and accurate reporting.

Multiply the taxable wages in step 5 by 4.40 percent to determine the annual tax amount. Divide the annual Colorado tax withholding calculated in step 6 by the number of pay dates in the tax year and round to the nearest dollar to obtain the biweekly Colorado tax withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.