Loading

Get Tn Annual Report Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN Annual Report Instructions online

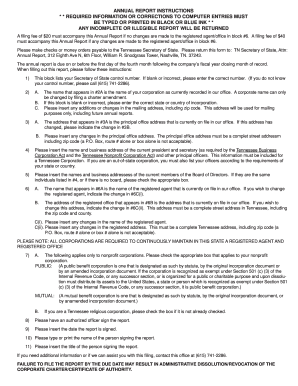

Filling out the TN Annual Report is an essential task for maintaining your corporation's good standing in Tennessee. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the TN Annual Report Instructions effectively.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter your Secretary of State control number in the designated block. If you do not have this number, you can obtain it by contacting the office.

- Confirm the corporation name listed. If it requires correction, enter the correct state or country of incorporation. Update the mailing address if necessary; this will be used to send future correspondence.

- List the current president, secretary, and any other principal officers of your corporation. Ensure this information is accurate, as it is required by the relevant Tennessee business legislation.

- Provide the names and business addresses of the current Board of Directors. If there are no separate directors, check the appropriate box to indicate this.

- Verify the name of your registered agent. If changes are necessary, enter the new registered agent's name in section C(i). Additionally, update the address of the registered office in section C(ii), ensuring it complies with Tennessee address requirements.

- If applicable, indicate the designation of your non-profit corporation by checking the corresponding box. Specify whether it is a public or mutual benefit corporation.

- Ensure that an authorized officer signs the report in the designated area.

- Input the date on which the report is signed.

- Type or print the name of the individual signing the report.

- Provide the title of the person who is signing the report.

- After completing all sections, review the form for accuracy. Save your changes, download a copy for your records, and print or share the form as needed.

Complete your TN Annual Report online today to maintain compliance and good standing.

Absolutely, Tennessee requires that all LLCs file an annual report each year. This is a vital component of maintaining your business status within the state. The TN Annual Report Instructions detail the requirements and deadlines. Following these steps ensures your LLC remains active and compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.