Loading

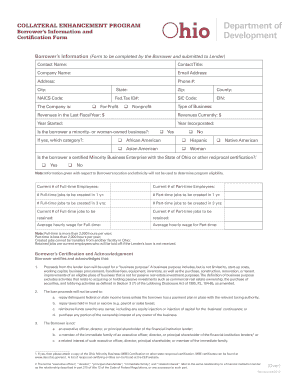

Get Collateral Enhancement Program Borrower's Information And Certification Form Borrower's Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the COLLATERAL ENHANCEMENT PROGRAM Borrower's Information And Certification Form online

Completing the COLLATERAL ENHANCEMENT PROGRAM Borrower's Information And Certification Form online is a crucial step for borrowers seeking financial assistance. This guide will provide you with a clear and structured approach to accurately fill out the form, ensuring that all necessary information is provided.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the Borrower's Information And Certification Form online.

- In the form, begin by entering the contact name of the borrower in the designated field, followed by their title and the company's name.

- Provide the email address, physical address, phone number, city, state, zip code, and county, ensuring all details are accurate.

- Fill in the NAICS code, Federal Tax ID number, SIC code, and EIN where applicable. This information helps identify the type of business you are operating.

- Indicate whether the company is for-profit or nonprofit by selecting the appropriate option. Enter the type of business and the revenues for the last fiscal year and currently.

- Provide the year the business started and the year it was incorporated. Indicate if the borrower is a minority- or woman-owned business and select the appropriate category if applicable.

- Answer whether the borrower is a certified Minority Business Enterprise with the State of Ohio or equivalent certification.

- Report on the current number of full-time and part-time employees, the jobs intended to be created in one and three years, as well as the current jobs to be retained.

- Fill in the average hourly wage for full-time and part-time employees.

- Read the Borrower's Certification and Acknowledgement section carefully and confirm understanding by completing the signature, date, printed name, and title fields.

- Once all fields are filled out correctly, save the changes to the form, download it if needed, and be sure to email, mail, or fax the completed form to the provided contacts.

Take action now by filling out the COLLATERAL ENHANCEMENT PROGRAM Borrower's Information And Certification Form online.

Collateral is the term used to describe any asset offered by a borrower to a lender as security for a loan. It acts as protection for the lender to ensure the money they lend can be repaid in one way or another. If the borrower fails to repay the loan, the lender takes ownership of the asset to recoup the loan amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.