Loading

Get Oh Sos 561 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH SOS 561 online

Filling out the OH SOS 561 form is an essential step for corporations seeking to dissolve officially. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the OH SOS 561 form with ease.

- Press the ‘Get Form’ button to access the OH SOS 561 form and open it in your editor.

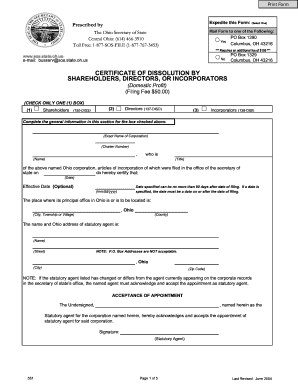

- Select whether you are filing by shareholders, directors, or incorporators by checking the appropriate box at the top of the form.

- Enter the exact name of the corporation as it appears in official records and provide the charter number in the designated fields.

- Complete the section asking for the name of the individual certifying the dissolution and their title within the corporation.

- Input the date when the articles of incorporation were filed with the Secretary of State.

- If applicable, provide an effective date for the dissolution, ensuring it is no more than 90 days from the date of filing.

- Specify the location of the corporation's principal office in Ohio by completing the city/township and county fields.

- Fill in the name and complete Ohio address of the statutory agent, ensuring that P.O. Box addresses are not used.

- If you checked the box for shareholders or directors, enter the names and complete street addresses of all directors and officers, making sure to avoid P.O. Box addresses.

- Affirm the method of authorization for the dissolution, whether it’s through a resolution at a meeting or signed documentation, depending on your selection.

- Complete the affidavit section if required, confirming notification of relevant governmental agencies.

- After reviewing all completed sections for accuracy, save the form and download, print, or share it as needed.

Begin completing your OH SOS 561 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a certificate of tax clearance in Ohio, you need to contact the Ohio Department of Taxation. Begin by ensuring that all your tax obligations are current, as any outstanding balances will delay the process. Once you have confirmed your eligibility, you can apply online or submit a written request, providing necessary documentation for verification. For more streamlined assistance, consider using USLegalForms, which can guide you through the requirements for OH SOS 561.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.