Loading

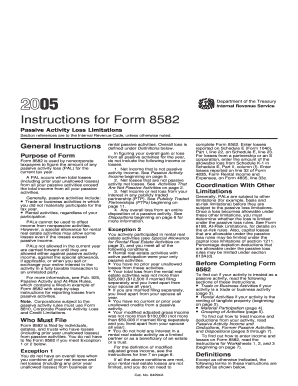

Get 2005 Instructions For Form 8582. Instructions For Form 8582, Passive Activity Loss Limitations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Instructions for Form 8582, Passive Activity Loss Limitations online

Filling out the 2005 Instructions for Form 8582 is crucial for noncorporate taxpayers who need to calculate passive activity losses. This guide provides a straightforward, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the form effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by reviewing the general instructions provided, which outline the purpose of Form 8582, important definitions, and details on who must file the form.

- Complete Part I of the form by entering your net income and net losses from all passive activities. Use Worksheets 1, 2, and 3 as necessary to gather the required data.

- If applicable, utilize Part II to determine the maximum amount of rental loss allowed for properties where you have actively participated.

- In Part III, calculate the commercial revitalization deductions, ensuring all values entered are positive amounts.

- Conclude by filling out Part IV, which consolidates the losses allowed for that year from all passive activities. Ensure you accurately allocate any allowed or unallowed losses.

- Finally, after reviewing all sections for accuracy, save your changes. Decide whether to download, print, or share the completed form as required.

Start completing your documents online now for a smoother tax filing experience.

Passive activity losses can only be used to offset passive activity income. They cannot be used to reduce your client's ordinary or earned income. Consequently, passive loss is generally disallowed as a deduction on a tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.