Loading

Get Business - Application - West Community Credit Union - Westcommunitycu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business - Application - West Community Credit Union - Westcommunitycu online

Filling out the Business - Application form for West Community Credit Union is a straightforward process that helps users secure the funding they need. This guide provides step-by-step instructions to ensure that you complete the application accurately and efficiently.

Follow the steps to complete your application successfully.

- Click 'Get Form' button to access the Business - Application form and open it for editing.

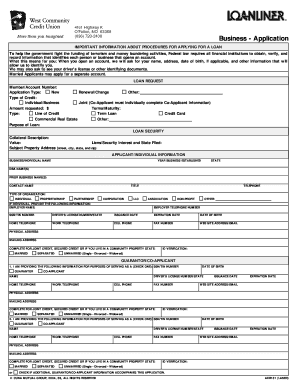

- Begin by filling out the loan request section. Enter your member or account number, select the application type (new, renewal/change, or other), and specify the type of credit you are applying for (individual/business or joint). Provide the amount requested and the desired terms/maturity. Select the credit type such as line of credit, term loan, credit card, commercial real estate, or other, and state the purpose of the loan.

- In the loan security section, describe the collateral you are offering and its value. Provide details of any liens or security interests and the subject property address.

- Fill out the applicant/individual information. Enter the business or individual name, year established, state of registration, and any DBA (doing business as) names or prior business names. Provide contact name, title, telephone number, and type of organization (individual, proprietorship, partnership, corporation, LLC, association, non-profit, or other). If applying as an individual, supply employer details, SSN/TIN, driver's license information, and contact numbers.

- If applicable, complete the guarantor/co-applicant section for any joint credit. Fill out the required information as specified, including name, SSN/TIN, and driver's license number.

- In the sources of income section, detail your gross annual income, including any alimony or child support if you choose to disclose it. List your total annual income from various sources such as salary, overtime, bonuses, commissions, dividends, rental income, and any other income.

- Provide the financial information required, including tax returns, balance sheets, and income statements. Ensure to check and attach the necessary financial documents as specified.

- Read and agree to the terms outlined in the signatures section, confirming that the information provided is accurate. Ensure to sign and date the application where indicated, including any required signatures from additional applicants or guarantors.

- After completing the form, save your changes. You can then download, print, or share the application as needed.

Start your application process online today to secure your loan with West Community Credit Union.

Canada has significant per-capita membership in credit unions, representing more than a third of the working-age population. Credit union membership is largest in Quebec, where they are known as caisses populaires (people's banks), and in western Canada.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.