Loading

Get In Reply Refer To: Taxpayer Identification Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the In Reply Refer To: Taxpayer Identification Number online

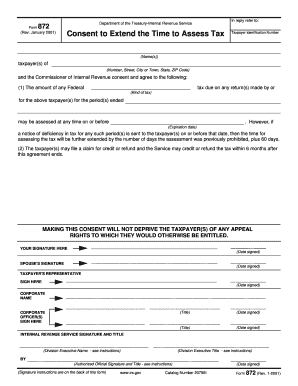

Filling out the In Reply Refer To: Taxpayer Identification Number form is essential for taxpayers seeking to extend the time to assess tax. This guide provides a clear and structured approach to assist users in completing the form online accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your taxpayer identification number in the designated field at the top of the form. This number identifies you for tax purposes.

- Fill in the names of the taxpayers in the spaces provided. Ensure that the names match those used in your tax return.

- Complete the address section by providing the number, street, city or town, state, and ZIP code relevant to the taxpayers.

- Specify the kind of tax relevant to this consent, such as income tax, gift tax, or others, and indicate the periods for which the consent is applicable.

- Detail the expiration date for the consent, ensuring it is clearly marked to prevent any confusion about the duration of the agreement.

- Both taxpayers must provide their signatures and the dates signed at the designated areas to validate the agreement.

- If applicable, include the signature of any taxpayer representative, accompanied by their title and the date signed.

- For corporate taxpayers, ensure the corporate name, titles, and signatures of officers are correctly filled out and dated.

- Once all sections are completed, review the form for accuracy and clarity. Save the changes, download, print, or share the completed form as necessary.

Complete your documents online for a smooth filing process.

A TIN is a general tax ID number, whereas an EIN is specifically an employer ID number. So, an EIN is a type of TIN. However, a TIN can describe other tax identification numbers besides an EIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.