Loading

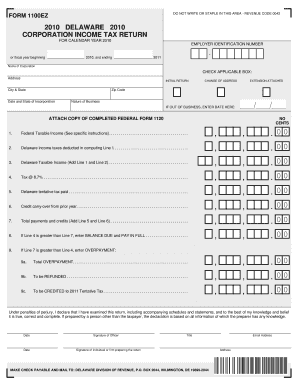

Get Download Fill-in Form (248k) - Division Of Revenue - State Of ... - Revenue Delaware

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Download Fill-In Form (248K) - Division Of Revenue - State Of Delaware online

Filling out the Download Fill-In Form (248K) for the State of Delaware is essential for reporting corporate income tax accurately. This guide provides a clear and structured approach to completing the form online, ensuring that users can navigate the process with confidence and ease.

Follow the steps to complete your corporate income tax return

- Press the ‘Get Form’ button to download the form, which will open in your preferred editing program.

- Enter the employer identification number of your corporation. This number is crucial as it identifies your business for tax purposes.

- Fill in the name and address of the corporation, ensuring that all details are accurate and current.

- Indicate the date and state of incorporation in the specified format (MM/YYYY), along with a brief description of the nature of business.

- Select the appropriate checkbox indicating whether this is an initial return, if the address has changed, or if an extension is attached.

- If applicable, input the date when the corporation ceased business operations, using the format MM/DD/YYYY.

- On Line 1, enter your Federal Taxable Income as reported on Line 30 of your Federal Form 1120.

- On Line 2, include the total amount of Delaware income taxes that were deducted while calculating Line 1.

- Calculate Delaware Taxable Income by adding Line 1 and Line 2, and enter that total on Line 3.

- To find the tax owed, multiply the amount on Line 3 by 8.7% and place that amount on Line 4.

- Enter the Delaware tentative tax that has been paid so far on Line 5.

- If you have a credit carryover from the previous year, input that amount in Line 6.

- Combine the totals from Line 5 and Line 6 to show your total credits available on Line 7.

- If Line 4 exceeded Line 7, record the balance due on Line 8. Conversely, if Line 7 is greater than Line 4, follow the prompts to detail the overpayment on Line 9.

- Complete the declaration section, signing and dating where necessary to affirm compliance.

- Finally, save your changes, and utilize the options available to download, print, or share the completed form.

Complete your document online now to ensure timely submission.

Copies are generally available for the current and past 6 years. Forms 4506 and 4506-T can be found on the IRS Web site at .irs.gov, under “Forms and Publications,” or can be ordered by calling the toll-free forms and publications order line at 1-800-TAX-FORM (1-800-829-3676).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.