Loading

Get Notice This Is A Proposal For A Claims-made And Reported Policy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NOTICE THIS IS A PROPOSAL FOR A CLAIMS-MADE AND REPORTED POLICY online

This guide provides users with a clear and concise overview of how to complete the NOTICE THIS IS A PROPOSAL FOR A CLAIMS-MADE AND REPORTED POLICY form online. Following these steps will ensure that all necessary information is accurately submitted for processing.

Follow the steps to successfully complete the form online.

- Click the 'Get Form' button to access the form. This will allow you to open and use the document in an online editor.

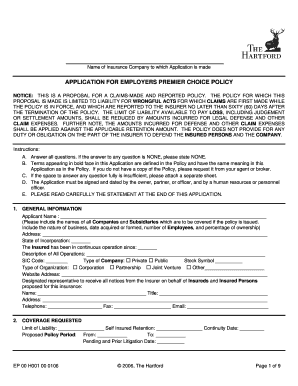

- Begin with the 'General Information' section. Provide the applicant's name, business address, state of incorporation, and the date the insured has been in continuous operation. Include a brief description of the operations and the SIC code.

- In the 'Coverage Requested' section, enter the limit of liability, self-insured retention amount, continuity date, and proposed policy period. Provide any relevant details on pending and prior litigation if applicable.

- Move to the 'Prior Insurance' section and indicate whether the insured currently holds Employment Practices Liability Insurance. If yes, provide the details of the current insurance carrier and policy.

- Complete the 'Third Party Claim Coverage' section by indicating if the insured is requesting coverage and complete the necessary questionnaire if applicable.

- In the 'Employee Information' section, fill in the total number of employees, including full-time, part-time, leased, and independent contractors. Provide geographical breakdowns and salary ranges as specified.

- Continue to the 'Past Activities' and 'Claim History' sections. Answer with full honesty about any past claims or actions against the insured, and if applicable, provide necessary supplementary forms.

- Review the 'Employment Policies and Procedures' section. Indicate if the insured has a human resources department, what policies are in place, and how performance evaluations are conducted.

- Finally, provide the 'Corporate History' and 'Claims Handling Procedures.' List the individuals responsible for reporting and handling claims. Ensure all required documents are included.

- At the end of the form, make sure that all signatures are completed, including the authorized officers’ signatures and dates. Review the entire application for completeness.

- Once all sections are complete, you can save changes, download a copy, print the form, or share it as needed.

Complete your NOTICE THIS IS A PROPOSAL FOR A CLAIMS-MADE AND REPORTED POLICY online today for efficient processing.

Key Takeaways: A claims-made policy only covers those that occur and are reported within the policy's timeframe, unless tail coverage is also purchased. An occurrence policy provides lifetime coverage for incidents that take place during a policy period, regardless of when the claim is reported.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.