Loading

Get Scr 20:1.15 Safekeeping Property; Trust Accounts And Fiduciary ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCR 20:1.15 Safekeeping Property; Trust Accounts and Fiduciary Accounts online

Navigating the requirements for the SCR 20:1.15 Safekeeping Property; Trust Accounts and Fiduciary Accounts can be complex. This guide provides clear, step-by-step instructions to help users complete this essential form online, ensuring accurate submission and compliance with state regulations.

Follow the steps to successfully complete the SCR 20:1.15 form online.

- To begin, click the ‘Get Form’ button to access the SCR 20:1.15 form. This will direct you to an editable version of the form where you can begin entering your information.

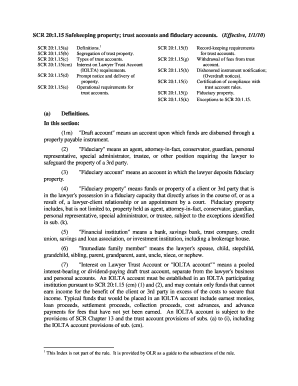

- Start by filling in the 'Definitions' section. Clearly define any terms that are applicable to your case according to SCR 20:1.15(a). This section includes important definitions such as 'fiduciary', 'trust accounts', and 'IOLTA'.

- Proceed to the 'Segregation of Trust Property' section (SCR 20:1.15(b)). Ensure that you document how client funds will be kept separate and properly identified. This requirement emphasizes the necessity of maintaining identifiable accounts for trust property.

- Next, fill out the section on 'Types of Trust Accounts' (SCR 20:1.15(c)). Differentiate between IOLTA and non-IOLTA accounts based on the funds received and their anticipated income generation. Specify which accounts you will use for client funds and explain your selection process.

- Document the operational requirements as outlined in SCR 20:1.15(e). Ensure you specify the financial institution you will use and confirm its compliance with safety and insurance requirements.

- Review the 'Record-Keeping Requirements' (SCR 20:1.15(f)). Make sure you are aware of the necessary records to maintain for each trust account, including transaction registers and monthly statements.

- Complete the sections related to the withdrawal of fees from the trust account (SCR 20:1.15(g)). Outline the procedures for notifying clients regarding any disbursements, ensuring transparency.

- After filling in all sections, double-check your entries for accuracy. Save your form. You may choose to download, print, or share the completed form as needed for your records.

Complete your SCR 20:1.15 Safekeeping Property; Trust Accounts and Fiduciary Accounts form online today to ensure compliance with state regulations.

Trusts are used mostly for estate planning, and are very popular as a 'fund' for the future of the settlor's children. Fiduciaries, on the other hand are used mostly in corporate structures to hide (only prima facie) the identity of the ultimate beneficial owners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.